Here are some of the biggest DeFi events of 2020

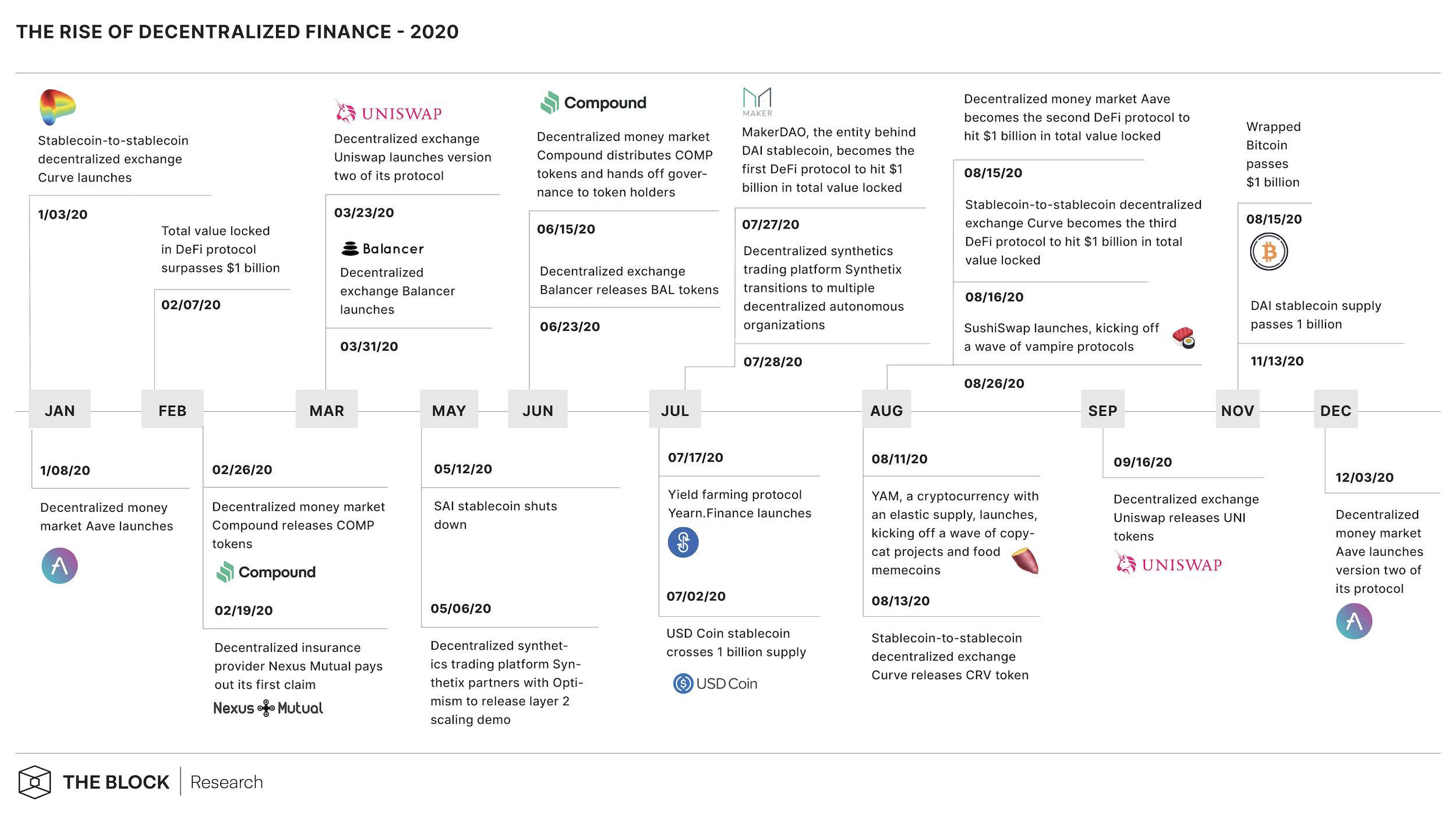

2020 was a year of notable events, and the same is true for the decentralized finance (DeFi) ecosystem. In 2020, DeFi saw the shut down of the SAI stablecoin, the yield farming trend take off, and multiple DeFi projects cross $1 billion in total value locked.

Here are some of the most important things to happen to decentralized finance this year.

- UNI token launch: On September 16, the leading decentralized exchange Uniswap launched its own governance token UNI. At various points, Uniswap's volume rivaled centralized exchanges like Coinbase.

- SushiSwap ushers in “vampire mining”: SushiSwap launched as a fork of decentralized exchange Uniswap in August. SushiSwap incentivized Uniswap liquidity providers with its own governance tokens to take liquidity away from Uniswap. Vampire mining was born.

- Compound distributes COMP tokens to users and hands over control of its protocol: June 15 marks the day the decentralized money maker Compound circulated its COMP token and gave governance control over to its users.

- Yearn.Finance started a farming craze: Yearn.Finance launched on July 17, establishing a protocol to find the best returns in the DeFi universe by investing deposited funds through different DeFi protocols. Yield farming mania commenced.

- Wrapped Bitcoin passes $1 billion: Wrapped Bitcoin (WBTC) is an ERC-20 token pegged to bitcoin. It lets bitcoin holders access the Ethereum-based DeFi ecosystem. August 15 was the day wrapped bitcoin supply broke $1 billion.

For more insights from the 2020 market, check out The Block Research 2021 Outlook Report.

TAGS