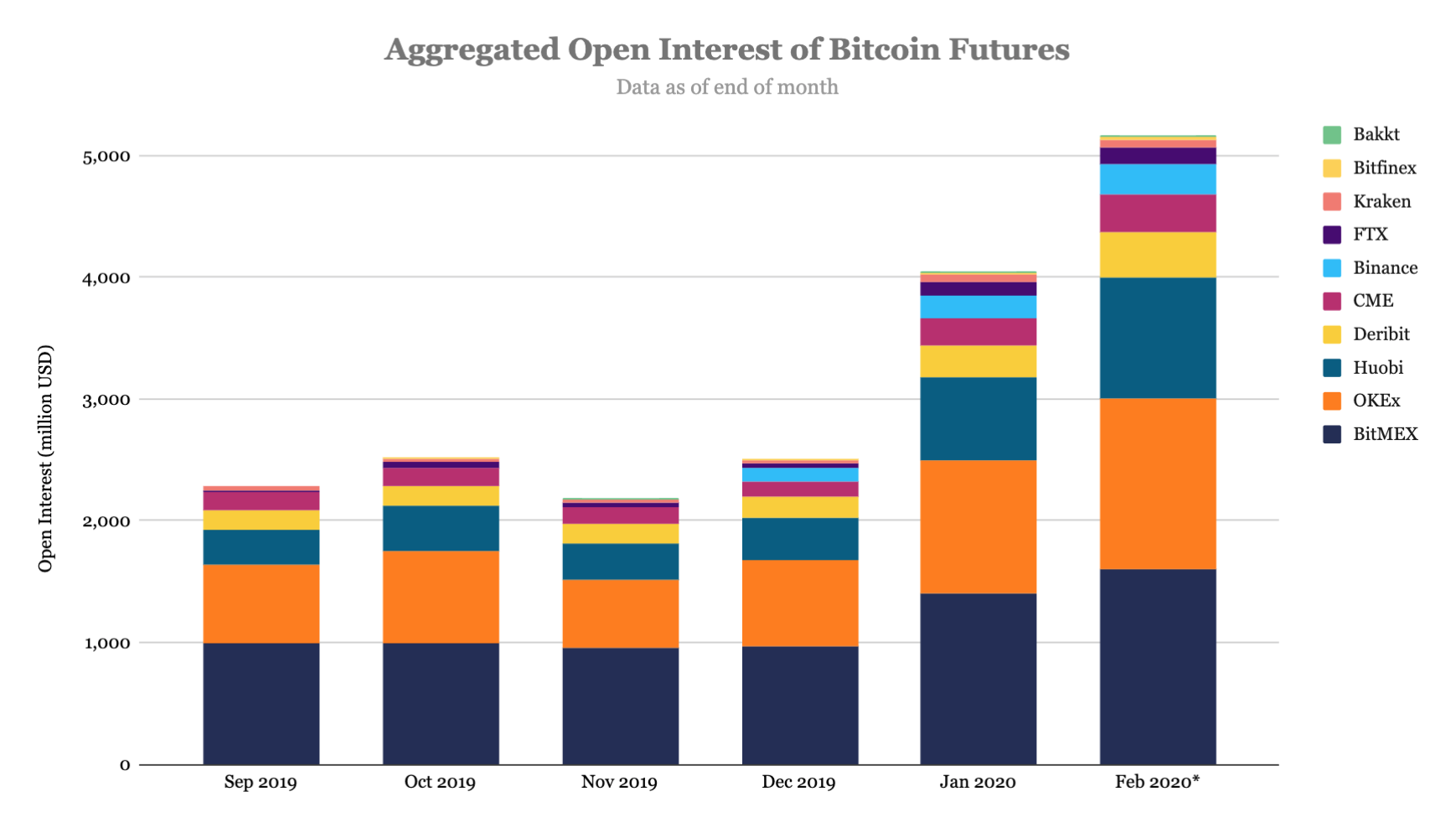

Open interest for Bitcoin futures surpasses $5 billion

Aggregated open interest (OI) for Bitcoin futures has surpassed $5 billion on Feb. 13, according to data compiled by The Block. Open interest refers to the value of outstanding futures contracts that have not been settled yet. An increase in open interest signals that more money is flowing into the market and that traders are anticipating a near-term rise in the underlying volatility.

BitMEX, a cryptocurrency futures venue incorporated in the Seychelles, currently has the largest open interest of $1.6 billion; about 31.0% of the total aggregated sum. BitMEX's dominance has dwindled in recent months, falling from 44% in November. BitMEX is followed by Chinese exchanges OKEx and Huobi, which have about $1.4 billion and $1 billion in open interest respectively.

CME is currently the fifth most popular venue for trading Bitcoin futures with about $312 million in open interest while Bakkt only has about $18 million. The Block's analyst Ryan Todd noted the total reportable traders (those that are trading +25BTC) hitting CME’s product on a weekly basis registered all-time highs last month; while the concentration of total open interest among the top 4 largest long traders is now at all-time lows (~20%, down more than 30% since May 2018).

Source: The Block, Skew