Bitcoin doesn’t incentivize green energy

Quick Take

- Maximilian Feige is a cybersecurity consultant based out of SF, with past experience in energy through his work with Varun Sivaram at the Council on Foreign Relations. You can follow him on Twitter @fiege_max.

The cryptocurrency community loves a good narrative: “Fat Protocols Thesis;” “Bitcoin as a Store of Value;” “Miner Death-Spiral” — the list goes on. Spurred on by a recent CoinShares report on mining trends, Bitcoiners have taken to arguing that the network’s energy demand has a net-positive environmental impact. Their reasoning is that, as energy buyers of last resort, miners have been drawn to cheap renewables in otherwise hopelessly remote locations: “stranded assets.”

… further studies may yet prove that, at least in terms of the environment, not only does cryptocurrency do no harm, it could actually be doing good… Bitcoin mining may in fact be acting as an electricity buyer of last resort.

— Pg. 10, The Bitcoin Mining Network

This reasoning incorrectly assumes a) that renewable energy implies carbon-free and b) that energy markets operate as free markets. Miners cannot chase after curtailed energy for free, nor do they have any market incentive to pursue environmentally-friendly operations. This post will demonstrate how the evidence presented in the CoinShares report lends itself to a far different conclusion under more scrutiny.

For a tl;dr summary of this post:

- Bitcoin mining has concentrated around regions with excess hydropower and it appears likely that >51% of the network runs on renewable energy. However, as miners have flocked to the electricity generated by large-scale mega dams, it remains intellectually dishonest to classify their operations as either carbon-free or environmentally-friendly. Free markets fail to price in externalities; why should Bitcoin miners act any differently?

- Energy curtailment occurs when grid operators pay utilities to turn off generation services during periods of excess energy. In theory, Bitcoin miners would time their operations such that they coincide with peaks in renewable energy, when the price should be cheapest. But look across the world and you’ll find that no grid offers this type of supply-based pricing. In fact, most miners are better off running their operations during off-peak periods, when curtailment rates are at their lowest.

- Stranded assets present a real niche market opportunity for Bitcoin mining. The caveat? Miners have no incentive to build out new energy generation. As energy nomads, they’re far more inclined to repurpose shuttered or underperforming energy infrastructure. Think coal and hydro, not solar and wind.

- CoinShares should have applied more rigor in deriving its 78% renewable energy mix figure, conducting its energy consumption comparable analysis, and presenting trends in curtailment reduction.

For disclosure purposes, I do volunteer as a community ambassador for Enigma and have invested in Ethereum, both of which intend on implementing Proof-of-Stake. Some have taken offense to this in the past.

Conflating Renewable Energy with Environmental Impact

Christopher Bendiksen of CoinShares followed up on their report with a post entitled, “Beware of Lazy Research.” He reiterated that hydropower:

- Comprises “the largest component, by far,” of Bitcoin’s energy profile

- Allows Bitcoin to be “cleaner than almost every other industry”

- Has no compelling transport or storage alternative to Bitcoin mining

Unfortunately, Bendiksen appears to have forgone his own advice in making the leap from the first point to the second. For if he had conducted any research at all, he would have noticed that his own team’s analysis contradicts his line of thinking. How so?

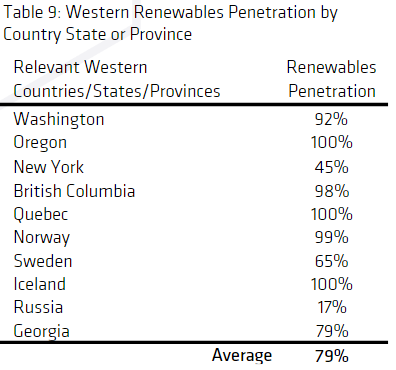

Page 8 of the report attributes the Chinese provinces of Sichuan and Yunnan with contributing renewable energy for some ~45% of the network’s hashrate. It then provides the reader with the table on the left, stressing that miners have sought out Europe and North America specifically for low hydropower utilization rates.

The recurring trend across these regions? Aside from Iceland and Sweden, they all claim ownership of some of the world’s largest mega dams. And for most of them, there’s an associated story about an influx of miner interest.

- Sichuan has the Xiangjiaba Dam. It’s the world’s sixth largest.

- Yunnan has the Xiluodu Dam. It’s the world’s third largest.

- Washington has the Grand Coulee Dam. It’s the world’s seventh largest.

- Oregon has the 1,242 MW capacity Bonneville Dam.

- New York has the the 1,957 MW Moses-Saunders Power Dam.

- British Columbia has the 2,917 MW capacity W. A. C. Bennett Dam.

- Quebec has the Robert-Bourassa Dam. It’s the world’s tenth largest.

- Norway has the 1,240 MW capacity Kvilldal Dam.

- Russia has the Krasnoyarsk Dam. It’s the world’s eighth largest.

- Georgia has the Enguri Dam. It’s the world’s second highest concrete dam.

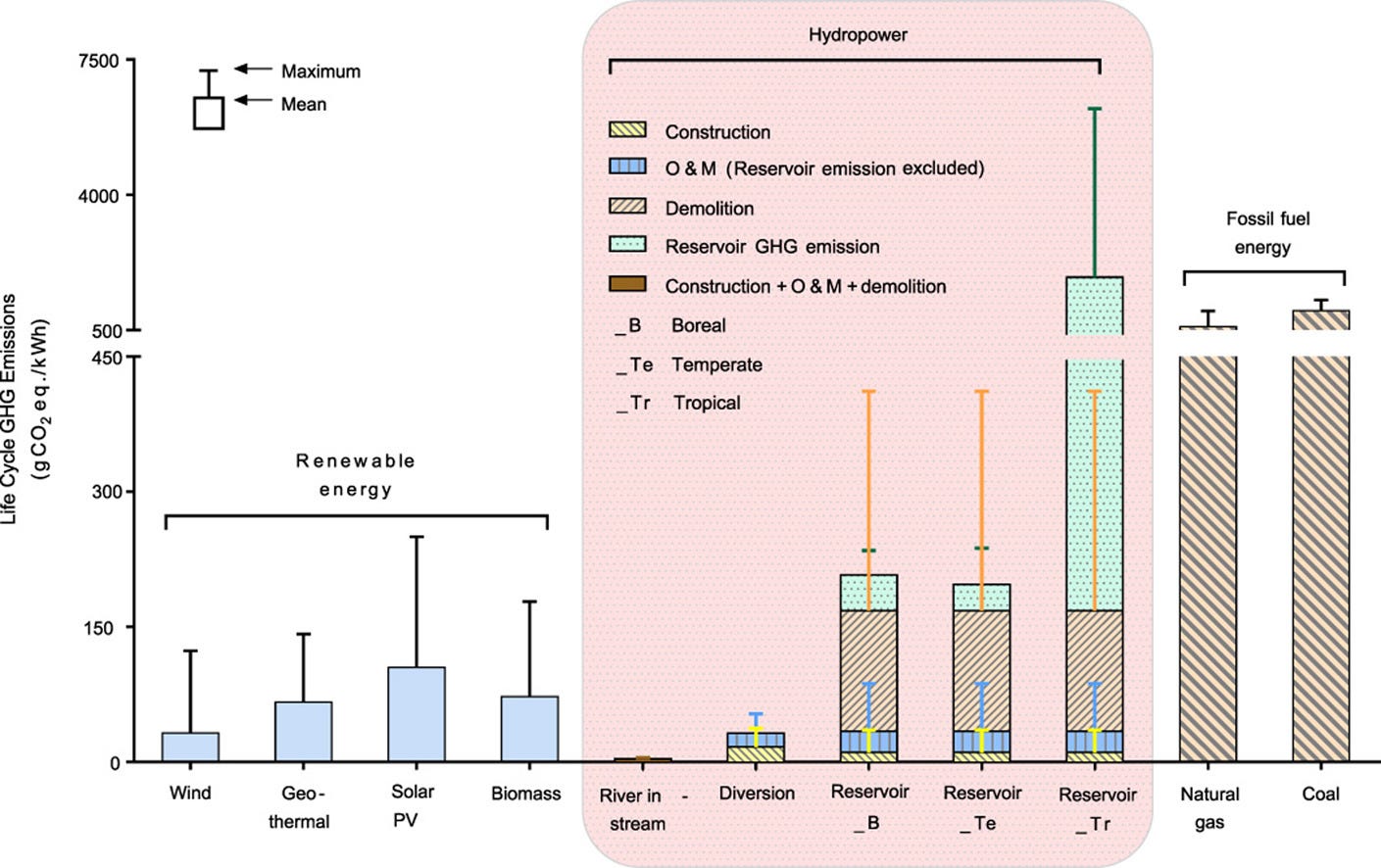

Now, you might consider it obvious that miners would hone in on the largest sources of untapped electricity — the bigger, the better. This phenomenon matters because the environmental impact of hydropower at scale differs vastly from solar and wind. Not only does the construction of mega-dams have significant ecological implications, total lifecycle greenhouse gas emissions can rival those of fossil fuel-based generation. Look to US federal policy on renewable energy credits or the UN’s 2016 renewable energy investment report, and a political unwillingness to categorize large-scale hydropower as “clean” energy becomes apparent.

The graphic below showcases how the cycle of biomass decay, anaerobic digestion, and return growth associated with damming results in greenhouse gas emissions. It’s important to note that the global warming potential (GWP) of methane ranges from 34x to 86x that of carbon dioxide.

Bendiksen’s claim, that Bitcoin is one of the world’s cleanest industries, falters once the global warming potential of large-scale hydropower gets charted alongside low-impact renewables and traditional fossil fuels. With miners concentrating around the world’s largest mega dams (i.e. right tail outliers), Bitcoin mining could possibly be one of the world’s dirtiest industries.

Chances are that if you’re reading this, you have no qualms with the energy consumption of Proof-of-Work. You consider it to be a fitting cost for personal monetary sovereignty, and wouldn’t mind if it ran purely on brown coal or the suffering of tortured bureaucrats. What should concern you about the CoinShares report is its intellectual inconsistency. In taking a free market approach to approximating the energy mix of Bitcoin’s hashrate, its claim that miners will foster renewable energy development implies that exchanges price in mining’s environmental impact. As miners have no other incentive than to mine the cheapest bitcoins, this narrative fails to hold water.

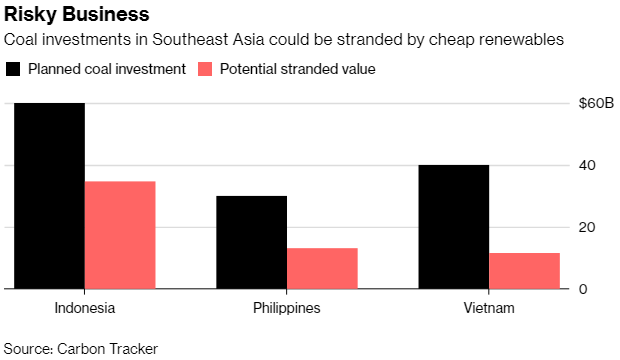

Today, the cheapest form of electricity comes from large-scale hydropower. Tomorrow, it might come from Venezuelan oil as a way to subvert sanctions, or Indonesian coal as its export market shrinks. Simply increasing energy demand in a few parts of the world is not going to lead to a renaissance in clean energy R&D or policy development — miners have no skin in that game. If we allow this narrative to become Bitcoiner dogma, we become complicit in giving miners a free pass on their hyper-regional energy parasitism.

Understanding Energy Market Design

The report’s discussion of curtailment similarly attributes free market participants with more agency than they have in practice. Claiming that mining consumes excess grid capacity, it paints the picture of miners timing their operations to capitalize on near-free renewable energy generation peaks. Little incentive actually exists for private miners to do so.

For example, let’s take an average spring day in California:

Notice that curtailment rates align most closely with spikes in solar power generation — this is a result of the duck curve phenomenon documented in solar-biased grids. On average, 8.5% of the energy generated between 10 AM and 4 PM will simply get grounded by utilities at a net-loss to the California Independent System Operator (CAISO). It would stand to reason that the marginal price for electricity during this period would dip due to oversupply. Within the context of Bitcoin mining, we’d expect opportunistic miners to pile into the market until the rate of curtailment approaches 0%.

And yet, because energy markets depend on public infrastructure and utility monopolies, demand dictates consumer pricing more so than does supply. California’s five utilities all price electricity with flat rates and tier systems that incentivize consumption outside of peak-demand times, most often in the dead of the night. This issue persists across different grids as well:

- Washington’s premier utility, Avista, bases its electricity prices off of individual user consumption. This presents little incentive for miners to exploit excess hydropower during spring melt, or peaks in wind generation at dusk and dawn.

- Chile’s solar curtailment rates can range anywhere from 10 to 40%, but consumer rates are determined through an auction mechanism on a six month basis every April and November.

- Even in China, where inaccurate central planning has led to the high curtailment rates alluded to in the CoinShares report, rates are set sector by sector according to demand schedules.

This reality challenges the assumption presented in the CoinShares report, that Bitcoin miners directly consume excess grid generation. While they clearly benefit from lower prices in regions with an oversupply of renewable energy, consumer tariffs predominantly incentivize consumption patterns that do not align with peaks in renewable generation. Moreover, as miners enjoy lower cooling costs during the night, they become further discouraged from running their operations in sync with these rhythms. Even in the case of hydropower, miners have no reason to care that coal power acts as a crutch during dry seasons or drought if they pay normalized rates across the year.

While we’re at it, we can nip the two inevitable counterarguments to this conclusion in the bud:

- Wholesale Electricity Markets are closer to theoretical free markets in that grid operators engage in hourly auctions to purchase from utilities. Were industrial-scale miners granted access to these markets, they would act as the energy buyers-of-last-resort for otherwise curtailed electricity. However, most grid operators found the burden of accommodating miners to outweigh the advantages of potential curtailment minimization. Additionally, Grid+’s regulatory saga with ERCOT bodes ill for the prospects of a non-retailer entering these markets.

- Off-Grid Mining lends itself to the libertarian inclinations of the Bitcoin community, but simply lacks the scale necessary for industrial ASIC mining. While off-grid energy generation capacity amount to ~6.6 GW in 2017, industrial use comprised only 44%, and 95% of that figure came from bioenergy (i.e. for use in existing fossil fuel generation). We can look to the world’s largest off-grid solar facility having cost $4 million for a total capacity of 10.6 MW as an example of why the economics of going off-grid just do not make sense for today’s miners.

CoinShares allowed its political biases to cloud its analysis of miners’ energy market considerations. Its report’s implication that miners have price incentives to align their operations with excess renewable generation incorrectly characterized Bitcoin mining as a marginal consumer of curtailed energy. As long as monopolistic, political grids remain the dominant option for industrial-scale mining, cryptocurrency analysts will have to suspend their free market assumptions when wading into issues surrounding the legacy energy sector.

Identifying True Stranded Assets

CoinShares ends its report on a strong note with support for the stranded assets hypothesis originally proposed by Nic Carter of Castle Island Ventures and Dan Held of Picks and Shovels. You can read an in-depth explanation in Dan’s post. Its premise is sound: as long as mining rewards provide a marginal benefit greater than just curtailing a kWh of energy, Proof of Work presents an efficient use. With grid-scale storage solutions still a future fancy, Bitcoin mining will prove to be a niche solution to monetizing otherwise stranded energy assets.

Suggesting that the liberated revenue streams offered by stranded energy assets would lead to an expansion of renewable generation, however, warrants criticism. The corollary represents an extrapolation of an otherwise sound conclusion; it ignores the relevant stakeholder priorities and risk tolerances that render the claim a nonstarter in practice. Consider the following:

- Energy infrastructure investments have a time horizon of 20 to 30 years. When it comes to wind and solar power, the primary vehicle for raising funding is a power purchase agreement. A PPA relies on predictable forecasts to lock in a contract price for electricity generated — combine that with an average debt-to-equity financing ratio of 69%, and the industry’s risk aversion becomes apparent. To quote an article Nic shared, the “revenue from the mining operation [would] be unpredictable… it’s not clear… how they make a 20- to 30-year infrastructure investment backed against that kind of revenue stream.” That’s probably why Soluna needs a $100 million ICO to bootstrap their bootstrapping.

- Bitcoin miners seek out operational mobility; it’s crucial for them to have the geographic and contractual flexibility necessary to find the cheapest electricity available. There’s a reason companies like IOT Energy and DPW Holdings reopen energy generation sites, as opposed to building their own. It allows them to lock-in energy prices with flexible contracts without bearing the burden of capital outlays themselves. Moreover, the IOT Energy example highlights that the largest opportunity for monetizing inert stranded assets will probably remain coal.

- The role municipalities play in green-lighting energy development presents a chicken and egg problem. If the area already has a regional grid connection, operators will be loath to integrate miner consumption into their existing loads. If the area is remote, the cost of extending necessary public infrastructure out to the point of generation will outweigh the limited benefits Bitcoin mining returns to the local economy. Why would a municipality build out infrastructure for miners when they would just leave the moment their demand drives electricity rates into non-competitive territory?

Energy financiers, Bitcoin miners, and municipalities lack the common ground necessary for mutually-beneficial infrastructure development. The corollary put forward in the CoinShares report faces a dilemma, as it becomes difficult to match preferences on asset volatility and time horizon across all three stakeholder communities. Miners are effectively energy nomads, and the incentive structure simply isn’t there to assume that they’ll play a significant role in the expansion of new energy generation, let alone the renewable kind.

That should not distract from the fact that Bitcoin mining represents a clear value proposition for existing, underperforming energy assets. It’s already occurring de facto with miners seeking out inefficient hydropower, and curtailment at the utility level represents the next logical step. The barrier to entry for a utility to contract a third-party ASIC operator only shrinks as mobile mining solutions mature and OTC crypto desks enter the mainstream. This is already happening in real-time, as Paraguay’s Golden Goose project shows.

Ad Hoc Commentary

A number of points within the CoinShares report need addressing but don’t fit in with the three main channels laid out here. These points are:

CoinShares and the 78% Renewable Figure

You can find the tweetstorm detailing my disbelief at CryptoShares claiming that 78% of Bitcoin hashrate comes from renewable energy *as a lower bound* below. Because of intermittent power generation, you cannot assume that renewable energy penetration serves as a proxy for renewable energy generation. This remains true even for hydropower, due to the seasonal fluctuations alluded to earlier in the post. At the very least, outliers like the coal-powered mining hub of Ordos in Inner Mongolia alone contributing 4% of network hashrate suggest that, if anything, the 78% figure should be considered an upper bound.

Geographic Realities of Energy Consumption Comparisons

CoinShares went out of its way to include (zero knowledge) snark at the end of its report by comparing the energy consumption of Bitcoin with that of console video games. Globally, the latter outpaces the former, 4.9 GW to 4.7 GW annually. This riff alludes to Dan Held’s popular “energy police” meme.

Now, let’s see what CoinShares wrote on Page 5 of that very same report:

The key consideration driving the location decision for these miners is the presence of low-cost electricity, high-speed internet, and in the case of the Northern regions, low temperatures that reduce the need for additional cost of cooling.Bitcoin mining is hyper-localized. Its energy consumption impacts a handful of grids the world over, loading them with the burden of sustaining a global phenomenon. Global video game usage spans hundreds of grids and utilities. As Bendiksen himself pointed out, you cannot analyze energy issues without accounting for geographical constraints. Saying 4.7 GW is a cheap price to pay for an internet of money, and understanding that 4.7 GW of consumption on a low-double digits number of grids is unsustainable, are not mutually exclusive.

Upcoming Trends in Energy Consumption and Grid Management

High curtailment rates are to renewable energy as price volatility is to Bitcoin: they’re both the product of nascent market formation. A number of factors support the idea that energy curtailment rates will decline in the future:

- The explosive rise in EV adoption will simultaneously increase demand for on-grid consumption and alter consumer patterns. China and California lead the surge in EV sales and anticipate curtailment rate reductions as a direct result.

- Development of HVDC applications continues to progress, with 2018 seeing the announcement of China’s first Voltage Sourced Converter HVDC network. While CoinShares correctly pointed out that the technology has had a lukewarm reception over the past the decade, other inefficiencies in the Chinese grid system have contributed to the lack of success. The global trend remains firmly in favor of deploying HVDC to better connect remote energy assets.

- The roll out of 5G networks 2020 onward will spur the development of smart grid strategies better capable of optimizing energy generation and consumption patterns.

These solutions to energy curtailment will not take hold over night, and leased Bitcoin mining presents a compelling stopgap for utilities. The question remains, will Bitcoin derisk to the point utilities are willing to engage with it before curtailment becomes a problem of the past?

Concluding Thoughts

Proof-of-Work has enabled the internet of money in a borderless, stateless, and ownerless fashion. The energy it consumes in securing the Bitcoin network does not represent a waste. And frankly, until either Ethereum switches over to Proof-of-Stake or an Avalanche implementation successfully takes hold, we have no other alternative to enabling decentralized cryptocurrencies.

This does not mean that the Bitcoin community is free to pass off biased analysis as dogma. The claims levied in the CoinShares report do not hold water, and yet online forums and media outlets have simply accepted them as truth for the past month and a half. Bitcoiners have taken to comparing the phenomenon to a honey badger in the past, and frankly that air of disinterested arrogance is a better alternative to this feigned intellectualism.

Bitcoin incentivizes cheap electricity. The free market price does not reflect whether this cheap electricity was generated in an low-carbon or low-impact manner. Bitcoin miners have honed in on large-scale hydropower and coal to gain an edge over one another, and have done so through the retail markets with no direct role in energy curtailment. Claiming that they will facilitate an expansion of renewables infrastructure when neither miners nor traditional energy stakeholders share any common skin in the game is the wrong conclusion.

I’ll leave you with the following reflection. Brandon Quittem began a series late in 2018 comparing Bitcoin’s adoption to the growth of a mushroom. I considered it one of the best crypto thoughtpieces in some time, and the Bitcoin community rallied around it. The analogy is apt, but once you realize that the honey mushroom referenced by Brandon is considered a parasite, you need to understand that Bitcoin will behave similarly. Bitcoin hashrate feeds off of the cheapest electricity in a hyper-localized fashion, sucking markets dry until miners drive prices back up with their demand. The combination of miner mobility and their disinterest in reinvestment results in a destructive, not constructive force.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.