Decentralized derivatives exchange dYdX raises $10 million in Series B

Quick Take

- Decentralized derivatives exchange dYdX has raised $10 million in Series B funding.

- With fresh capital at hand, dYdX looks to expand its platform and team, as well as its footprint in Asia, with a particular focus on China.

- “China is a very important market for dYdX,” founder Antonio Juliano told The Block.

Decentralized derivatives exchange dYdX has raised $10 million in Series B funding.

Announcing the news on Tuesday, dYdX said the round was led by Three Arrows Capital and DeFiance Capital, with participation from Wintermute, GSR, Scalar Capital, and others. Existing investors, including a16z and Polychain Capital, also backed the round.

With fresh capital at hand, dYdX looks to expand its platform and team, as well as its footprint in Asia, with a particular focus on China.

"China is a very important market for dYdX, DeFi, and the global cryptocurrency industry," dYdX founder Antonio Juliano told The Block. "dYdX is committed to long-term success in China and is investing heavily in growth."

dYdX recently hired its first international employee, Yiran Tao, to focus on driving growth in China, Juliano told The Block, adding that the exchange is also focused on expanding in Korea, Japan, and Singapore.

Founded in 2017, dYdX offers three different types of products — perpetual contracts with up to 10x leverage, spot trading, and margin trading with up to 5x leverage.

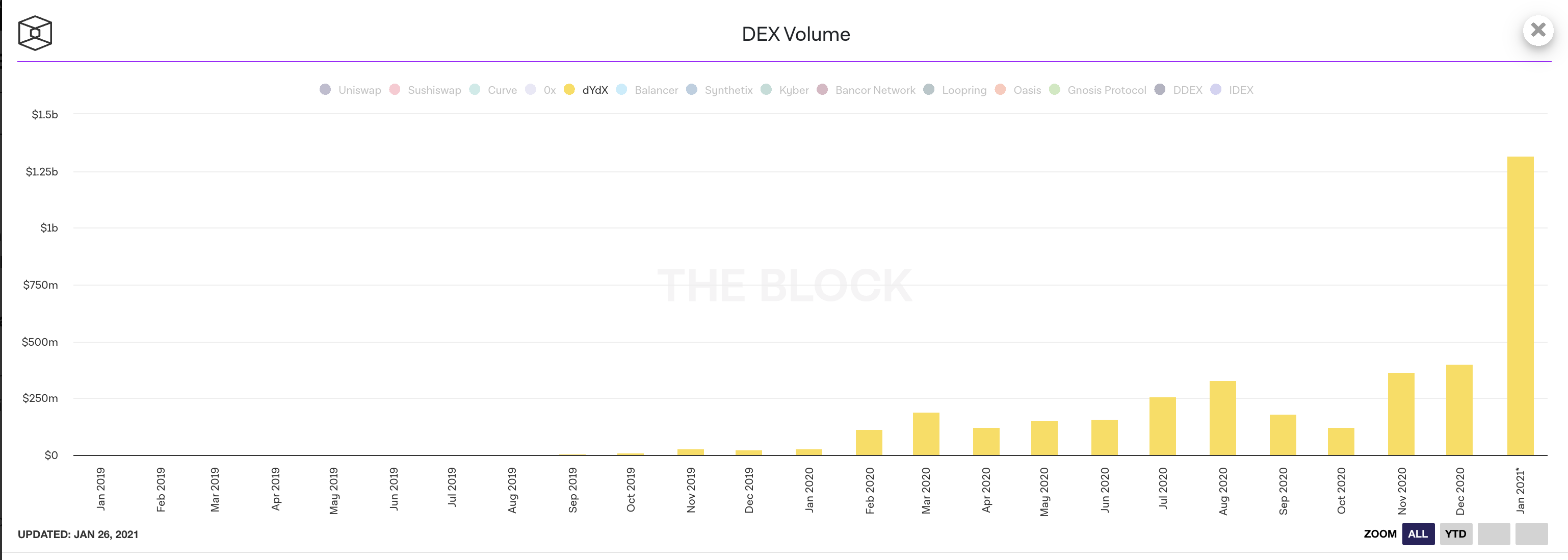

The exchange achieved record trading volume across all three products in 2020, reaching a total cumulative trade volume of $2.5 billion — up 40 times from $63 million in 2019.

This year so far, dYdX's total cumulative trade volume has already crossed $1.3 billion within just one month.

"We believe dYdX will continue to gain market share in relation to CEXs [centralized exchanges] due to decreased switching costs, simple onboarding, better UI & UX, increased security guarantees, and more attractive trading products," Juliano told The Block. "Over 2021, we aim to launch a variety of crypto markets, with the goal of ultimately becoming on par with major CEXs in the space."

To that end, dYdX is looking to enhance its platform further and expand its current team of 14 (it doubled its headcount last year). One of the major features that dYdX is launching soon is an Ethereum Layer-2 scaling solution that utilizes ZK-Rollups.

dYdX is built on Ethereum, and given the blockchain network's limited transaction capacity and high transaction costs, several DeFi projects, including dYdX, are looking to implement rollups. The core philosophy of rollups is that transaction data is on-chain, while transaction computation is done off-chain to scale Ethereum's capacity.

There are two main types of rollups: ZK-Rollups and Optimistic Rollups. The former guarantees that transactions are valid with zero-knowledge proofs, while the latter allows transaction validity to be challenged on the Ethereum blockchain. Optimistic Rollups are currently the more flexible solution because it is easier to build smart contracts on them, while ZK-Rollups are technically more secure.

When asked why dYdX chose StarkWare's ZK-Rollups, Juliano told The Block that the exchange wanted a scaling solution that could be on mainnet "within a few months, not within some undefined timeline." For that reason, "we ruled out Eth2 and Optimism, which had not yet been on mainnet."

Juliano said rollups offer 100x+ scaling benefits without Eth2. dYdX is set to launch its StarkWare Layer 2 solution next month for cross-margined perpetual contracts.

Looking ahead, dYdX is also planning to decentralize its platform further and could even launch its own token.

"Our team has actively been researching how best to decentralize the protocol over time. Decentralization will be a gradual process that could ultimately result in a DAO [decentralized autonomous organization] to govern the community," Juliano told The Block.

The Series B brings dYdX's total capital raised to date to $22 million. The exchange has previously raised $10 million in Series A and $2 million in seed capital. Juliano declined to comment on dYdX's valuation.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.