Anthony Scaramucci's Skybridge has invested $182 million into bitcoin, according to deck

Quick Take

- Anthony Scaramucci’s Skybridge appears to be making a big bet on bitcoin, according to an investor deck obtained by The Block.

- The firm has already invested as much as $182 million into bitcoin on behalf of its funds.

- The deck says the firm has invested more than $25 million for a new bitcoin investment fund that went live in December.

Anthony Scaramucci's Skybridge Capital has already invested as much as $182 million to bitcoin on behalf of its investment funds, according to an investor deck obtained by The Block.

The fund of funds, which has a planned public debut for a new Bitcoin fund slated for next month, has partnered with a number of crypto firms including Fidelity Digital Assets and Silvergate. The deck says Skybridge "has invested $182 million in bitcoin on behalf of its investment funds."

In another section of the deck, the firm said it had invested $25.3 million for the new fund, which opened to the public in December. It's not clear if there is overlap between these two invested amounts.

Scaramucci is the latest financial services titan to be drawn to the digital asset world, following in the footsteps of Paul Tudor Jones' Tudor Investment Corp and Renaissance Technologies, which have made similar allocations.

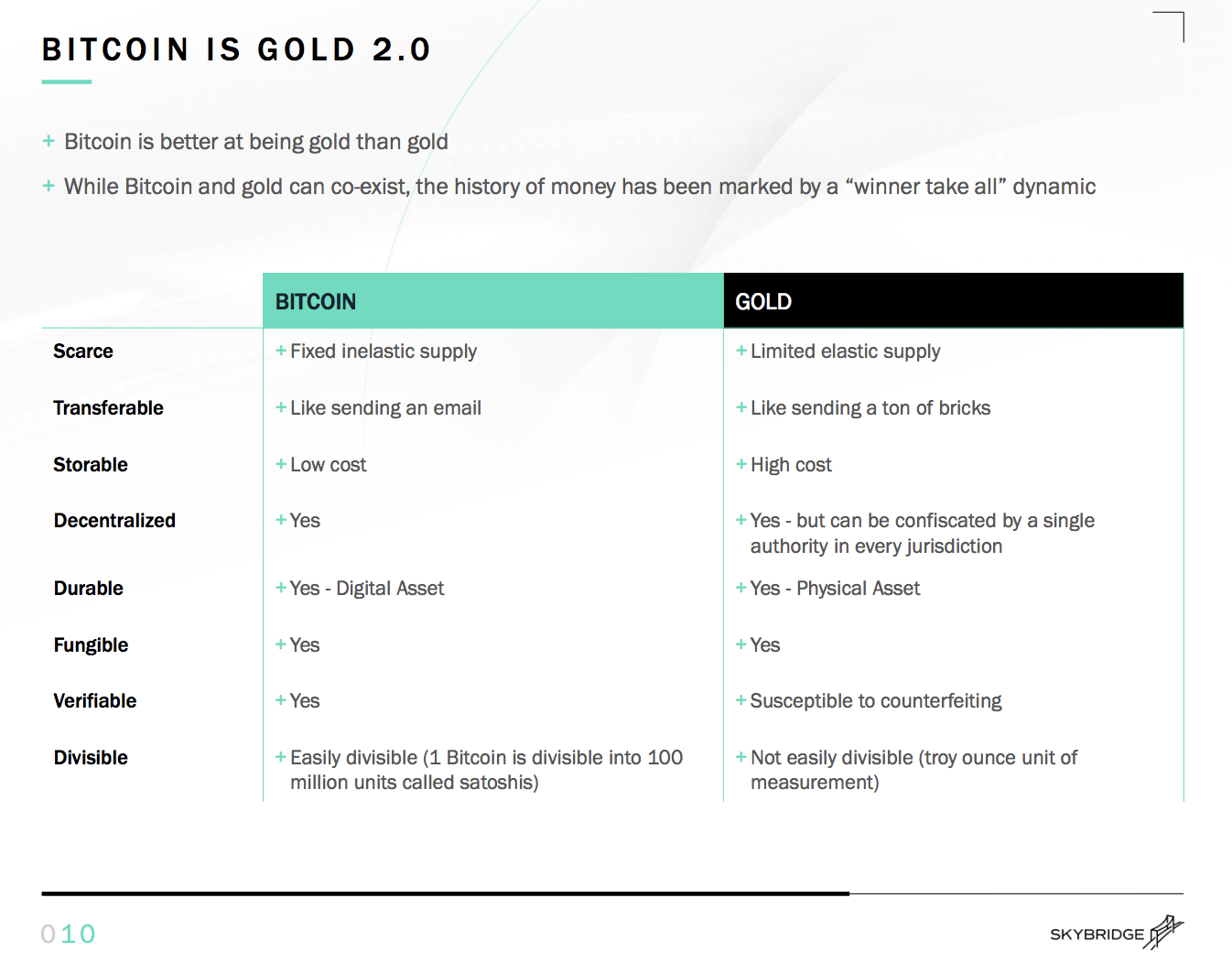

As for Skybridge, the firm expects the institutional push into the crypto market to continue. Bitcoin's properties as a superior version of gold as well as the market's maturation "and numerous discussions with large asset allocators" will result in more hedge funds, RIAs and insurance funds allocating capital to the digital asset, according to Skybridge.

The firm also expects a shake-up in the traditional 60/40 portfolio ratio of stocks and bonds will serve as a tailwind for bitcoin as investors look for new investment opportunities. This shift, according to Skybridge, is tied to the actions of the Federal Reserve and negative interest rates.

"Negative interest rates represent an existential risk to pension funds, insurance companies, and endowments that need to achieve targeted rates of return to meet financial obligations," the deck says.

A re-allocation of funds by such institutions from the fixed-income market to bitcoin would "produce a substantial increase in the price of bitcoin."

A message to Scaramucci seeking comment was not returned by the time of publication.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.