Crypto hedge fund Three Arrows Capital now holds 6.26% of GBTC shares, worth nearly $259 million

Quick Take

- Crypto hedge fund Three Arrows Capital has become the first qualified investor to hold more than 5% of Grayscale Bitcoin Trust (GBTC) shares

- Three Arrows Capital co-founder Su Zhu told The Block: “We are bullish on the GBTC demand”

- Zhu’s partner Kyle Davies said GBTC is one of the most liquid ways for equity investors to participate in bitcoin’s price appreciation

Cryptocurrency hedge fund Three Arrows Capital, co-founded by Su Zhu and Kyle Davies, now holds 6.26% of Grayscale Bitcoin Trust (GBTC).

The fund has amassed over 21 million GBTC shares, worth nearly $259 million or just over 20,230 bitcoins.

Notably, Singapore-based Three Arrows Capital is the first qualified investor to hold more than 5% of GBTC shares. Davies told The Block that the fund has today filed a Schedule 13G form with the U.S. Securities and Exchange Commission (SEC) for holding 6.26% of all shares in GBTC.

It is not clear whether Three Arrows Capital contributed “in-kind,” meaning whether it deposited its own bitcoins in exchange for GBTC shares. Davies declined to comment on the matter.

Most of the in-kind investments are done by institutional investors in order to arbitrage premiums over net asset value. Grayscale's products saw nearly 80% of inflows in in-kind during the third quarter of 2019.

GBTC demand

GBTC is a closed-end fund that invests exclusively in bitcoin. It lets investors get exposure to bitcoin through a traditional investment vehicle, with shares titled in investors’ names. Only accredited investors can purchase shares directly and those shares are publicly traded on the over-the-counter (OTC) market.

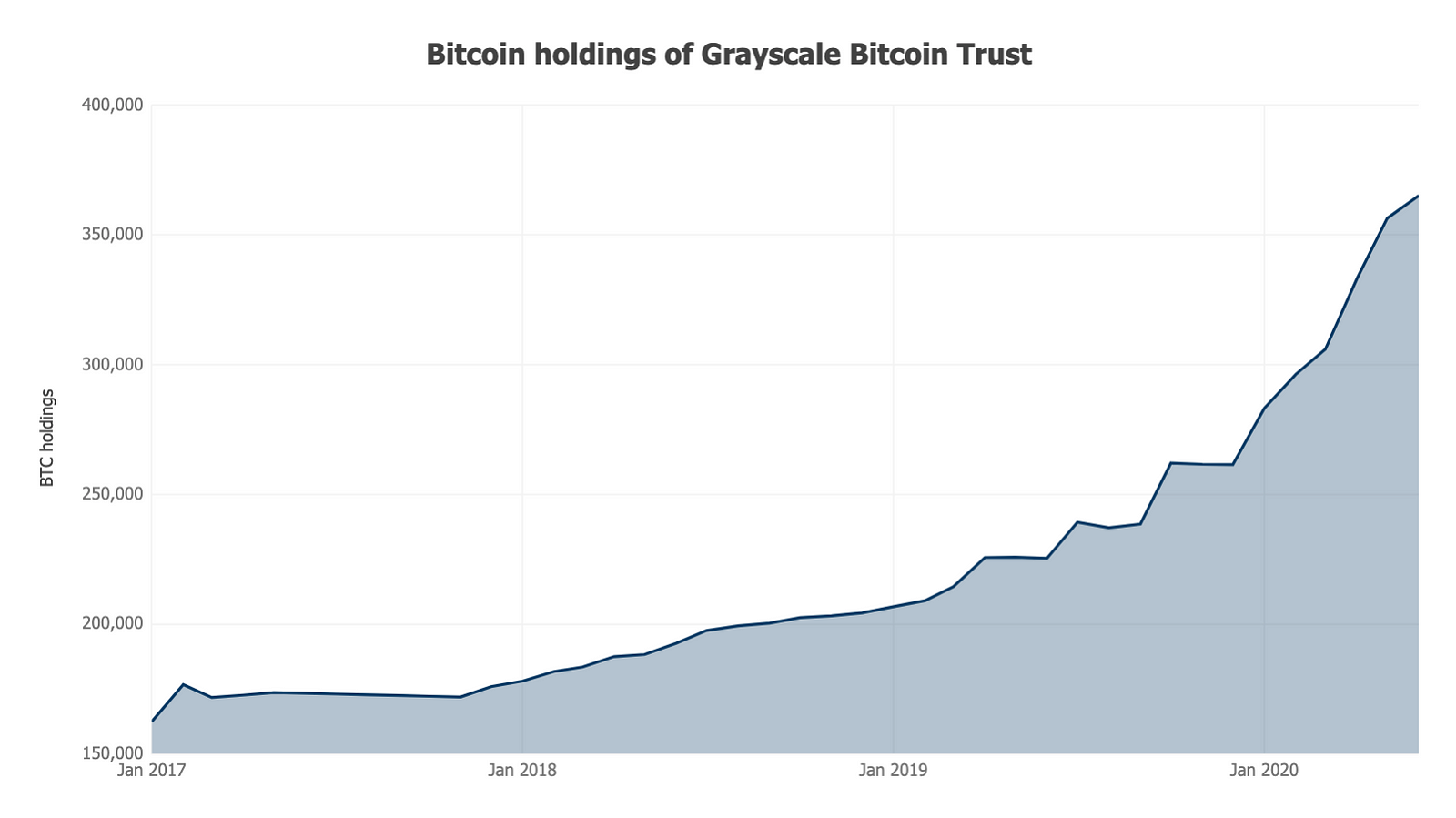

GBTC currently has all-time high assets under management, worth at $3.65 billion. In other words, the figure is the value of all bitcoins held in the trust. GBTC was launched in 2013 and now holds around 365,190 bitcoins on behalf of its customers.

Source: Grayscale, The Block Research

GBTC has seen high demand recently and is currently trading at $12.30 with 380,090,300 shares outstanding - this results in the market cap of about $4.68 billion. The net asset value of GBTC, on the other hand, is at $3.65 billion, which means it is trading at a premium of about 28% (figures are as of June 10).

“We are bullish on the GBTC demand,” Zhu told The Block. “Premium means inflows. There can be no premium without inflows.”

Davies expects “strong” inflows to continue in GBTC as Nasdaq hits all-time highs and bitcoin trades around $10,000. He believes that GBTC is one of the most liquid ways for equity investors to participate in bitcoin’s price appreciation.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.