CoinMarketCap rolls out new metric 'Liquidity,' aiming to fight fake trading volumes

Quick Take

- Crypto data provider CoinMarketCap has launched a new metric called Liquidity

- It will replace Volume as the default metric when ranking cryptocurrency pairs and exchanges

- Carylyne Chan, chief strategy officer of CoinMarketCap, said: “We hope to provide public good to the crypto markets by encouraging the provision of liquidity instead of the inflation of volumes”

Cryptocurrency data provider CoinMarketCap has launched a new metric dubbed “Liquidity,” aiming to combat fake trading volumes.

Announcing the news on Tuesday, CoinMarketCap said the new metric replaces "Volume" and serves as the default standard for ranking cryptocurrency pairs and exchanges on its website.

The Liquidity metric looks at several factors, including order-book depth changes and distance from mid-price. Calculations are made by polling the market pair at random intervals over 24 hours and averaging the result.

“We believe our adaptive methodology will make our metric very difficult to ‘game’ as orders would need to be placed close to the mid-price, or risk being counter-productive to the Liquidity metric scoring,” said Carylyne Chan, chief strategy officer of CoinMarketCap.

Earlier this year, CoinMarketCap was criticized by cryptocurrency asset manager Bitwise, which said the data provider ranks exchanges by volumes and nearly 95% of cryptocurrency trading volumes are fake.

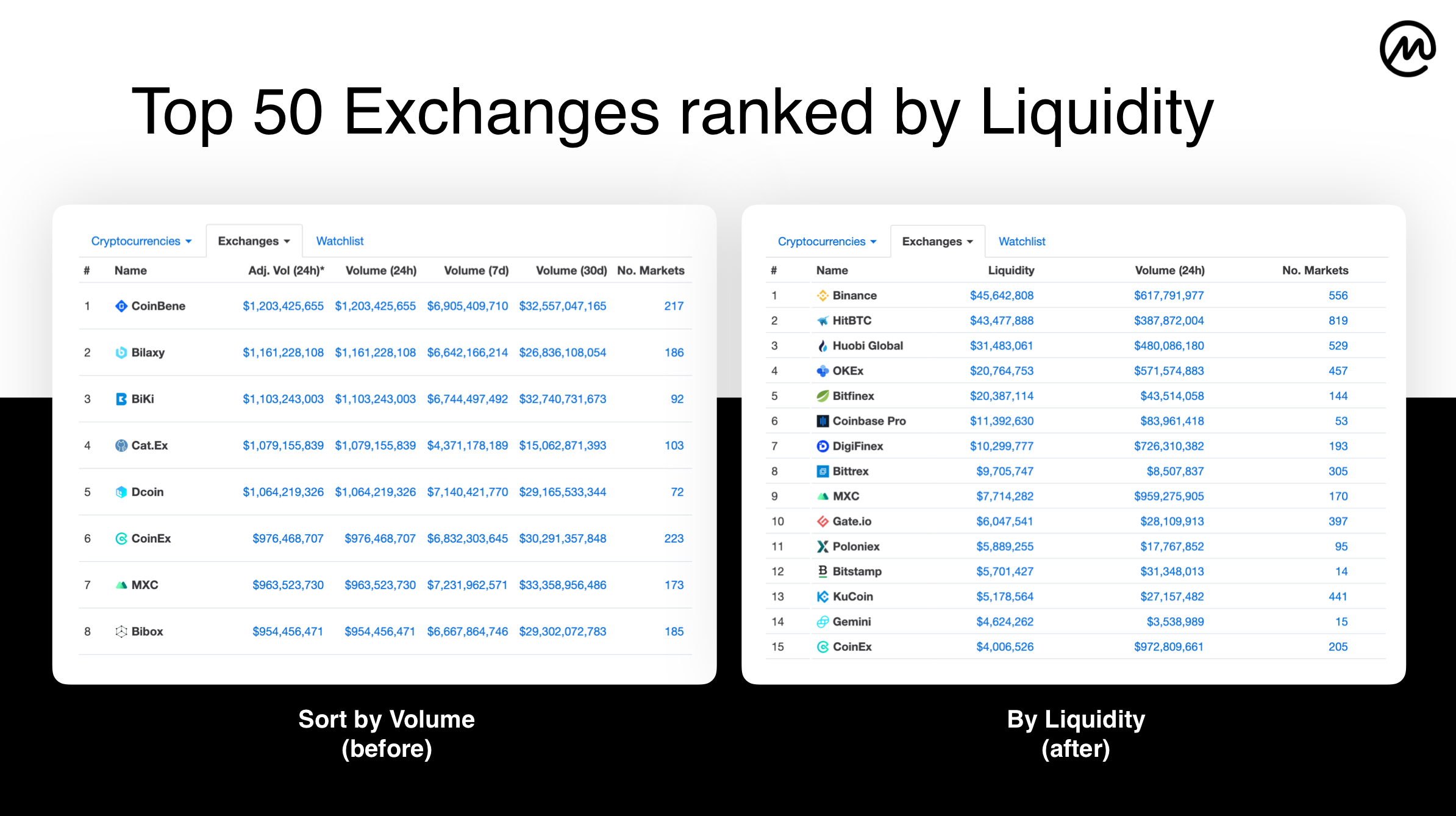

Before and after

The Liquidity metric has gone live with rankings of market pairs and top 50 exchanges. Notably, it shows that Singapore-based exchange CoinBene, which was ranked at the top for 24-hours volume figures, has been replaced by Binance during the same period, with the Liquidity metric. CoinBene had $1.2 billion worth of trades, while Binance just over $600 million.

“With our Liquidity metric, we hope to provide public good to the crypto markets by encouraging the provision of liquidity instead of the inflation of volumes," said Chan. CoinMarketCap first revealed the Liquidity metric in August.

More features

The firm has today also launched a jobs page, where companies can list job openings and people can search for new opportunities. The page shows that CoinMarketCap charges $699 for posting five jobs. The firm has also launched its mobile apps in simplified Chinese, with more languages in the pipeline, including Spanish, Japanese, Korean and Russian, per the announcement.

From Nov. 21, CoinMarketCap will also provide its data via Yahoo Finance. Looking ahead, it will also launch an educational site. Just last month, the firm released a new page, where it publishes interest rates offered on several cryptocurrencies, to help users compare and choose a suitable product.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.