SEC files emergency lawsuit against Veritaseum to stop spending millions of dollars in ICO money

Quick Take

- The SEC has filed an emergency lawsuit in federal court to prevent Veritaseum from spending $8 million raised in an ICO

- The SEC alleges that Veritaseum knowingly misled investors about prior business success and investor demand for the tokens

The SEC has filed an emergency lawsuit in federal court in Brooklyn to prevent Reginald Middleton and Veritaseum from spending $8 million from an ICO the SEC contends was fraudulently undertaken in 2017 and early 2018. The Court entered a temporary restraining order freezing multiple bank accounts and ethereum wallet addresses on August 12. A show cause hearing is scheduled for Monday, August 26, 2019 at 10:00 A.M.

The SEC alleges that the offering made "material misrepresentations and omissions" about the VERI tokens, "knowingly misled" investors about prior business success and investor demand for VERI and also made manipulative trades to increase the token value in order to increase investor interest.

According to the SEC, Middleton tried to escape SEC registration requirements by characterizing VERI as "pre-paid fees", "software" or "gift cards."

As the Complaint puts it:

Cognizant of the federal securities laws’ application to VERI, Defendants so-called “utility” token, claiming that the VERI tokens’ supposed uses were variously as (1) a “prepaid fee” that could be exchanged for “consulting and advisory services” and used to buy “unlimited access to research,” (2) a “universal key to gain access to Veritaseum P2P OTC Direct Contracts,” and (3) a means to access “Veritaseum Legacy Asset Exposure Pools.”

In fact, the Complaint alleges, the tokens were plainly securities -- there was no functional software, "legacy asset pools", or "consulting service." Also, promises about "ready to ship" products were false, as were claimed sales to institutional investors.

What appears to have precipitated this filing, in part, is that after the SEC told Defendants' lawyers that they were likely to recommend filing of enforcement action, Defendants "moved more than $2 million in remaining offering proceeds from a blockchain address they controlled into other addresses, and used a portion of those funds to purchase more precious metals." When asked by staff to not spend any more of the SEC funds, Defendants refused.

The complaint alleges that Defendants engaged in securities fraud under the Securities Act and the Exchange Act, the unregistered sale and offer of securities under the Securities act, and market manipulation under the Exchange Act.

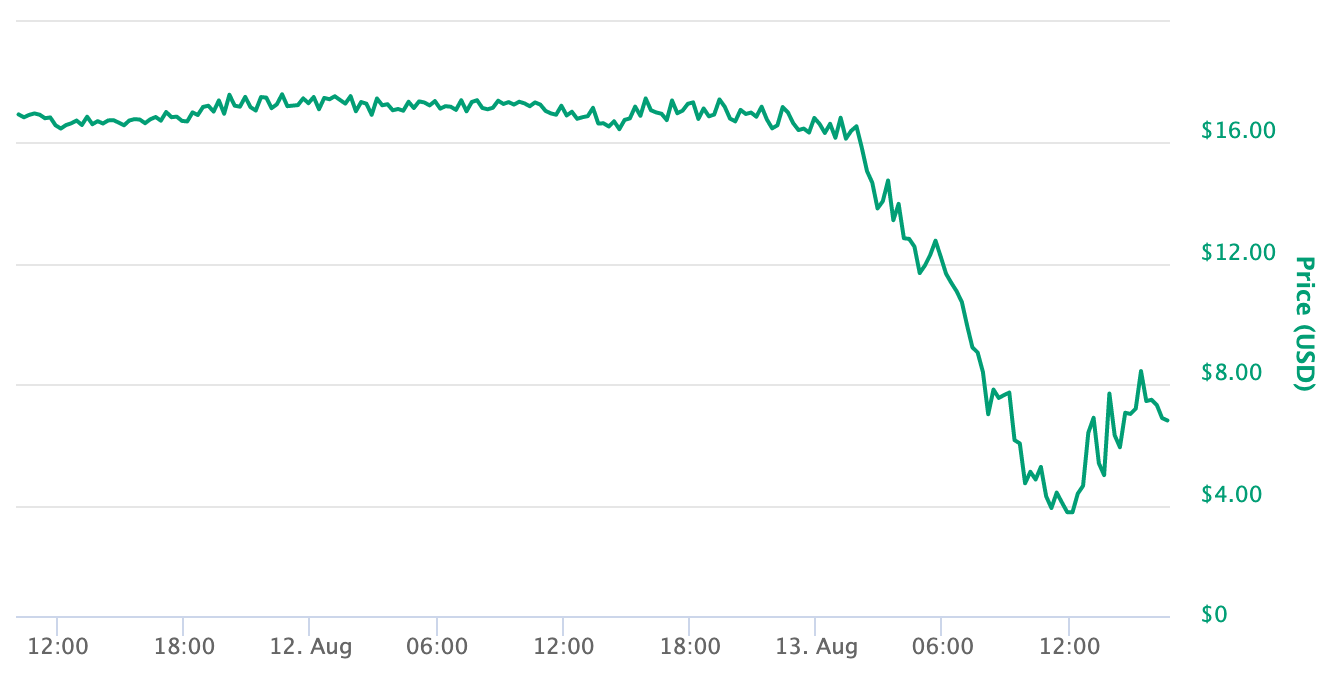

At the time of writing, the price of VERI tokens is down more than 60%.

SEC_v_Middleton_et_al by Anonymous QbU0qGmoU5 on Scribd

Veritaseum Order by Anonymous QbU0qGmoU5 on Scribd

This is a developing story. We will report further as further developments become known.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

TAGS