Tether, USDC and DAI transaction volume surpasses Visa's 2023 monthly average: Nansen

Quick Take

- Transaction volume in the past 30 days for Tether, USDC, and DAI, has surpassed Visa’s 2023 monthly average, according to Nansen.

Crypto's three largest stablecoins — Tether  USDT

-0.054%

, USDC and DAI — have seen higher volumes in the past 30 days than Visa’s average monthly total from last year, according to onchain specialist Nansen.

USDT

-0.054%

, USDC and DAI — have seen higher volumes in the past 30 days than Visa’s average monthly total from last year, according to onchain specialist Nansen.

Nansen data showed that the largest stablecoin by market capitalization, Tether, processed $654 billion in the past 30 days, while DAI managed over $394 billion of flows and USDC saw $321 billion in trading volume.

"The total for the three at $1.369 trillion is higher than the monthly average for market leader Visa in 2023," said Nansen. That compares to $1.23 trillion, the monthly average of Visa's yearly $14.8 trillion volume in 2023.

Transaction volume in the past 30 days for Tether, USDC, and DAI, has surpassed Visa's 2023 monthly average. Image: Nansen

Nansen’s data showed that Tether alone processed nearly as much in monthly volumes as Mastercard, the second largest card provider in the world. Mastercard’s monthly average volumes were $750 billion in 2023, totaling $9 trillion for the year. Data showed that Tether also outstripped PayPal, which managed $125 billion on average each month last year.

USDC takes lead in stablecoin transactions, Visa claims

In an April report, Visa claimed that Circle’s USDC should be classed as the leading stablecoin in terms of transactions volume.

Visa said it cleansed stablecoin transaction data of inorganic activity and only counted the largest stablecoin amount transferred within a single transaction to show USDC surpassing its market contenders.

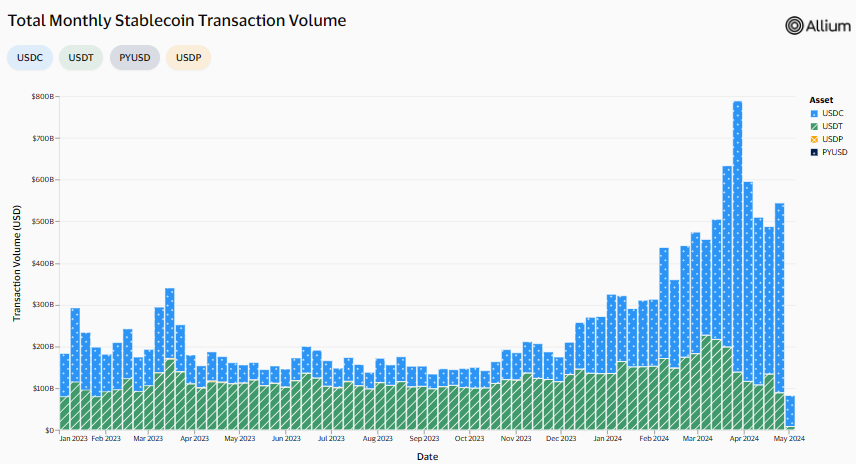

Transaction volumes for USDC surpass those for USDT when adjusted for the Visa report: Image: Allium data.

According to the report, the removal of bot activity, complex smart contract interaction and automatic transactions from centralized exchanges, saw USDC transaction volume surpass that for USDT on a weekly basis.

"Only transactions that have been sent by an account that has initiated less than 1,000 stablecoin transactions and $10 million in transfer volume, over last 30 days, are counted. This removes various bot activity as well as automatic transactions from large entities like centralized exchanges," the report said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.