Bitcoin flash crash below $9,000 on BitMEX's USDT spot market had no impact on derivatives, exchange says

Quick Take

- Crypto exchange and derivatives trading platform BitMEX witnessed a flash crash on its BTC-USDT spot market and is currently investigating the “unusual activity.”

- The firm said the temporary drop below $9,000 per bitcoin did not impact the platform’s derivative markets or the index price for its bitcoin derivatives contracts.

Crypto exchange and derivatives trading platform BitMEX saw bitcoin flash crash below $9,000 on its USDT spot market late Monday but had no impact on derivatives, according to the firm.

BitMEX is currently investigating “unusual activity” involving large sell orders on its  BTC

-0.41%

-USDT spot market, the exchange posted on X. “This does not affect any of our derivative markets, nor the index price for our popular XBT derivatives contracts,” it added.

BTC

-0.41%

-USDT spot market, the exchange posted on X. “This does not affect any of our derivative markets, nor the index price for our popular XBT derivatives contracts,” it added.

“Someone just dumped 400+ BTC over 2 hours in 10-50 BTC clips on the XBTUSDT pair on Bitmex eating 30%+ slippage. They must've lost $4m+ at least,” pseudonymous crypto community member “syq” wrote. “I'm guessing that they're done (for now?). Total volume so far is just shy of 1,000 BTC over 3.5 hours with a low of $8,900. Now BitMEX have disabled withdrawals,” they added.

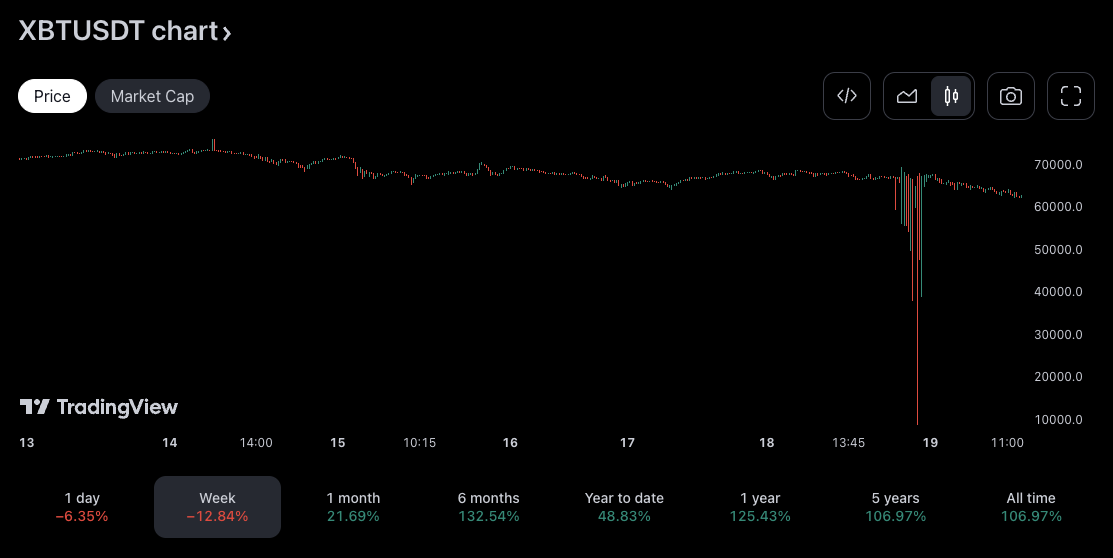

XBT/USDT on BitMEX. Image: TradingView.

In response, BitMEX clarified that it had not disabled withdrawals for all users but just a few accounts relevant to its ongoing investigation.

'Potential misconduct'

BitMEX later noted that it was investigating “potential misconduct” by traders in its BTC-USDT spot market, again re-iterating the incident had no impact on its derivatives markets amid reports of the flash crash.

RELATED INDICES

“This incident had no impact on our billion-dollar derivatives markets. It did not move mark prices, and no liquidations were triggered by it because our indices are independent and battle-tested,” BitMEX wrote.

Explaining the reason for the price drop, BitMEX said, “We create fair and equal markets for all by not employing internal market makers. The BTC sell orders this morning were simply too big and frequent for independent market makers and other traders to react to. As is standard, our compliance team is investigating the accounts and transactions triggering this price movement.”

Deposits and withdrawals continue to be processed as usual on the trading platform, BitMEX added.

Bitcoin is currently trading for $63,112, according to The Block’s price page.

The Block reached out to BitMEX for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.