Court orders Craig Wright to provide a list of trustees and comply with discovery

Quick Take

- Kleiman v. Wright, Order on Motion to Dismiss

- One of the issues involved discovery requests about Mr. Wright’s Bitcoin holdings and the nature of a blind trust that he claims they were sent to

- “[y]ou realize it is facially incredible that in 2011 your client transferred potentially billions of dollars in Bitcoin to someone and you can’t tell me who that was. You understand that, right?,” said the Court

- At the end of this hearing the Court stated unequivocally that Wright would be required to fully respond to the Plaintiff’s discovery request and provide (among other things) a list of the trustees and the beneficiaries of the trust

Disclaimer: These summaries are provided for educational purposes only by Nelson Rosario and Stephen Palley. They are not legal advice. These are our opinions only, aren’t authorized by any past, present or future client or employer. Also we might change our minds. We contain multitudes.

As always, Rosario summaries are “NMR” and Palley summaries are “SDP".[related id =1]

Kleiman v. Wright, 9:18-cv-80176-BB, S.D.Fl., Order on Motion to Dismiss, 6/11/2019 [SDP]

Hearing transcript | Motion to Compel | Response to Motion to Compel | Mediation Order

As a litigator you learn a couple of things early. Let the witness talk during deposition. Getting along with your opposing counsel isn’t a sign of weakness. The 1,000th page of a spreadsheet at 7 pm after nine hours of deposition usually isn’t the path to the promised land. Cold coffee is better than no coffee. And most importantly, don’t let your client’s discovery abuse get you sanctioned by a federal judge. This last principle appears to be on display in the Ira Kleiman v. Craig Wright litigation in federal court in Florida.

First a little background. Back on May 6 the court held a hearing in this case. One of the issues involved discovery requests about Wright’s Bitcoin holdings and the nature of a blind trust that he claims they were sent to. As the Court put it after some incredulous questioning of Wright’s lawyer, “[y]ou realize it is facially incredible that in 2011 your client transferred potentially billions of dollars in Bitcoin to someone and you can’t tell me who that was. You understand that, right?” I’ve included a link to the transcript above. It’s incredible reading and, well, wasn’t a great day for Wright (and even worse for his lawyers).

[related id=2]At the end of this hearing the Court stated unequivocally that Wright would be required to fully respond to the Plaintiff’s discovery request and provide (among other things) a list of the trustees and the beneficiaries of the trust. Emphasizing the seriousness of the order, the Court ended the hearing with this admonition:

But to be clear, and I think this is clear in my standing order, as you can tell I am not happy when this happens. When someone gets a discovery request, objects to it, forces the Court to rule and adjudicate the objections and then comes back at the end and says oh, by the way, we don’t have anything and we can’t get anything because that’s just a waste of the Court’s time. And your client needs to understand that. Your client needs to understand he is under the jurisdiction of this Court. I will not hesitate to order him to come to the United States and appear in front of me to explain himself. So I don’t know what other priorities he has in his life right now, but this better be one of them.

In other words, get it together, buddy, or you will lose this case. That is what this means.

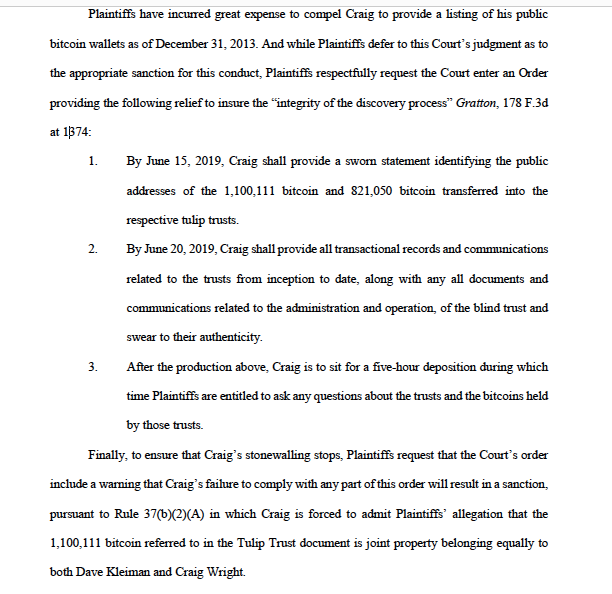

So … fast-forward to this week. Plaintiff filed a motion in which he said Wright has continued to fail to comply with the Court’s orders to produce full records of his pre-2014 bitcoin holdings. As a sanction, they asked the Court to enter the Order set forth below:

Wright responded and his lawyers argued that they had done everything required and it’s just all so very hard. They also say that Wright doesn’t know any of the addresses of the bitcoin held by the trusts, because cryptography:

The private key needed to access the encrypted file with the data necessary to retrieve information about bitcoin Dr. Wright mined after block 70 has been split into multiple key shares (in lay terms, multiple parts) through a version of “Shamir’s Secret Sharing Algorithm”, an algorithm created by Adi Sharmir to divide a secret, such as a private encryption key, into multiple parts. The key shares were then distributed to multiple individuals through the trusts. The Shamir method enhances security, prevents a single participant from unlocking an encrypted file and prevents a single participant from extracting the information in it. A certain number, but less than all, of the shares is needed to re-construct the private key. Dr. Wright purposely set up a Shamir system — both technologically and through legal trust formation — where he alone does not have ability to access the encrypted file and data contained in it. This Shamir system involves both splitting the private key into multiple parts or “shares” and distributing those key shares through the trusts in a manner where key shares are given to various holders. Thus, Dr. Wright does not know the public addresses of the bitcoin held by the trusts (i.e., the bitcoin mined by Dr. Wright in 2009 after block 70, through 2010).

The Court didn’t go as far as Plaintiff asked, but still entered an Order granting the Plaintiff’s motion “to the extent it seeks an order directing Defendant to produce a list of the public addresses of the all the bitcoin Defendant mined before 12/31/13, in accordance with the Court’s prior orders. In the event Defendant fails to produce this list by June 17, 2019, the Court will conduct a Show Cause evidentiary hearing (on one of the four dates offered by the Court) where Defendant will be ordered to testify and explain his non-compliance.”

My read on all of this — including the hearing transcript — is that the Court is on its last nerve and will sanction Wright, up to and including striking his pleadings and entering a default against him if he fails to do as ordered. It’s not clear that this will result in an adjudication on the merits that he is or is not Satoshi, by the way, and that was not raised by the Plaintiff in their motion to compel. This particular case is not squarely about the identity of Satoshi but about the ownership of property. With that said, if and to the extent that has been raised in the voluminous pleadings, it’s easy to see an argument being made that he can’t re-litigate the issue in another court under principles of res judicata and collateral estoppel (also known as issue and claim preclusion).

Big takeaway — do not aggravate a federal judge. It will piss them off and it won’t help your case. That is what is happening here. If Wright doesn’t right his discovery ship, it’s not going to go well for him. Given the fact that the case has been ordered into mediation with required attendance by the parties, this may provide an incentive to reach a quick resolution.

The Block is pleased to bring you expert cryptocurrency legal analysis courtesy of Stephen Palley (@stephendpalley) and Nelson M. Rosario (@nelsonmrosario). They summarize three cryptocurrency-related cases on a weekly basis and have given The Block permission to republish their commentary and analysis in full. Part I of this week's analysis, Crypto Caselaw Minute, is above.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.