Digital assets in a 'liquidity drought' as bitcoin hovers around $26,000: Glassnode

Quick Take

- The digital asset market faces a severe liquidity drought, according to Glassnode, with on-chain and off-chain volumes hitting historical lows.

- Long-term holders remain steadfast, while short-term holders teeter on the brink of significant unrealized losses.

The digital asset market is witnessing a significant liquidity crunch, with both on-chain and off-chain volumes plummeting to historical lows, according to the latest report by crypto market intelligence firm Glassnode.

With the market returning to a relatively narrow trading range, this decline in liquidity is reminiscent of the pre-bull levels of 2020, the Glassnode analyst said — arguing that “extreme apathy and boredom best describe the prevailing sentiment.”

Bitcoin, ether and stablecoin flow declines

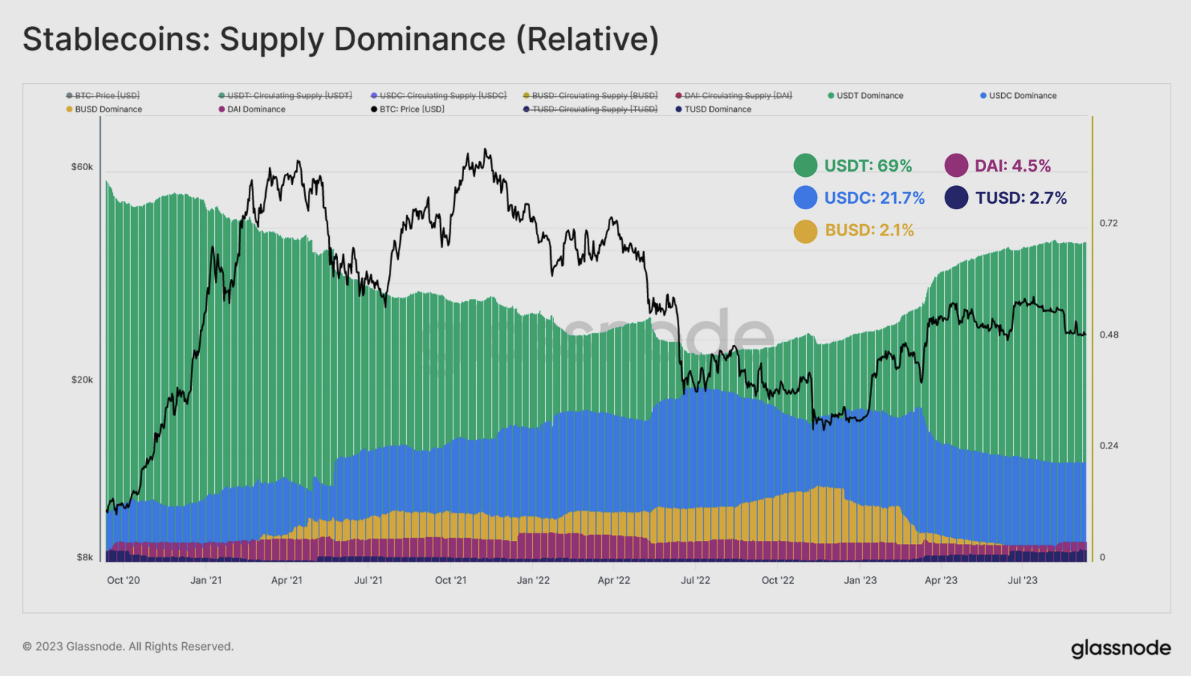

Stablecoins have seen a consistent decline in supply since April 2022, which Glassnode attributed to various factors, including the collapse of the Terra ecosystem and the opportunity cost of higher interest rates not passed onto non-yielding stablecoins.

While bitcoin and ether have seen a net inflow of capital since the year began, all three assets have returned to neutral or negative inflows since late August — suggesting stagnation and uncertainty, the analyst noted.

The market-realized value net capital change breakdown. Image: Glassnode.

Among the major stablecoins, Tether's  USDT

-0.026%

has expanded its supply by $13.3 billion since the November lows. However,

USDT

-0.026%

has expanded its supply by $13.3 billion since the November lows. However,  USDC

-0.068%

and

USDC

-0.068%

and  BUSD

+0.33%

have witnessed steep declines — falling $16.7 billion and $20.4 billion, respectively.

BUSD

+0.33%

have witnessed steep declines — falling $16.7 billion and $20.4 billion, respectively.

The USDC decline is likely a reflection of U.S. institutions moving capital to higher interest rate markets. BUSD’s decline could be due to issuer Paxos halting mints following the Securities and Exchange Commission’s enforcement action, the report stated. Tether's dominance in the stablecoin market surged to 69% as a result, increasing significantly from 44% in June 2022.

Stablecoin supply dominance. Image: Glassnode.

Quiet times on and off-chain

Despite a brief period of volatility coming into the month, Glassnode’s on-chain metrics reveal the total USD volume of Bitcoin  BTC

+6.22%

transactions has dropped to a daily average of $2.44 billion, mirroring the levels seen in October 2020, with minimal profit or loss locked in by the market overall, the analyst said.

BTC

+6.22%

transactions has dropped to a daily average of $2.44 billion, mirroring the levels seen in October 2020, with minimal profit or loss locked in by the market overall, the analyst said.

RELATED INDICES

Bitcoin entity-adjusted volume. Image: Glassnode.

In the off-chain derivatives market, bitcoin daily trading volume has also reached a historical level, falling to $12 billion for the first time since the 2022 lows.

Bitcoin futures volume. Image: Glassnode.

However, Glassnode noted some divergence in the bitcoin options market, with trading volumes increasing meaningfully — though they remain a magnitude smaller than futures. “This could be a reflection of the market preferring to use the leverage and capital efficiency of options to express their view during a period of tighter overall liquidity conditions.” the analyst said.

Hodling on

Despite the market's subdued state, the "holding" trend remains strong, Glassnode reported. The long-term holder cohort, which Glassnode defines as on-chain entities holding coins for more than 155 days, reached an all-time high of 14.7 million BTC. Meanwhile, the short-term holder supply — holding for less than 155 days — has dwindled to its lowest since 2011.

Long/short-term bitcoin holders. Image: Glassnode.

While profitability is gradually increasing for long-term holders, 26.7% of this supply is currently underwater, Glassnode noted. However, below the $26,000 price level, short-term holders are almost entirely underwater on their positions, arguably putting the more price-sensitive cohort a little bit on edge, the analyst said.

Bitcoin is currently trading at $26,110, according to CoinGecko data. Crypto’s largest asset by market capitalization has fallen around 5% since the end of August as a historically bad month for the industry continues.

BTC/USD price chart. Image: CoinGecko.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.