Multiple Ivy League universities, KKR back Dragonfly's new $650 million fund

Dragonfly, the crypto investment firm led by Haseeb Qureshi and Tom Schmidt, unveiled on Wednesday a new fund backed by $650 million in commitments.

Among those invested are Tiger Global and KKR as well as multiple unnamed university endowments. Dragonfly declined to name the universities backing the new fund.

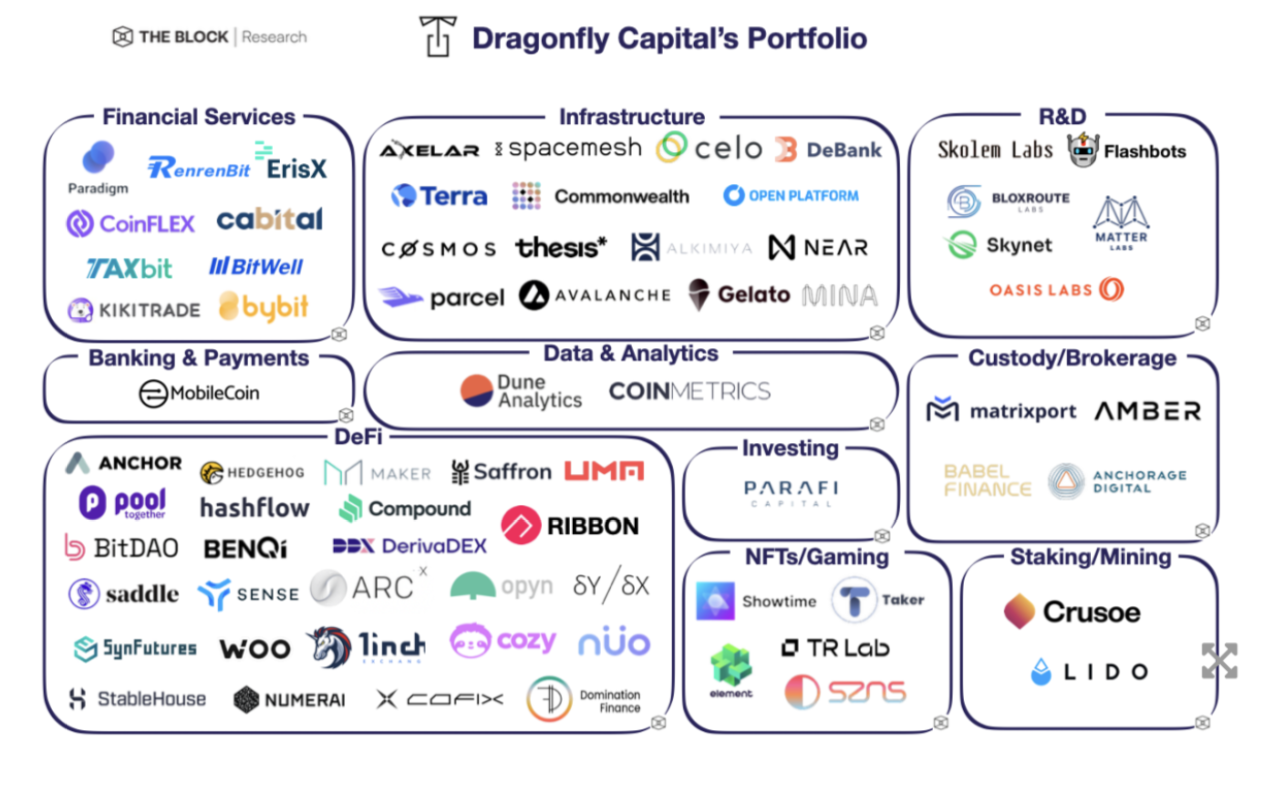

Dragonfly's new fund closed amid a flurry of new investment fund launches across the industry. Some of these new initiatives have come from the likes of Bain Capital, Electric Capital, and a16z. The new fund follows the close of Dragonfly's Ventures II fund last year.

Dragonfly's Qureshi said that the new fund will target the new wave of crypto entrepreneurs building in web3 and more nascent corners of the market.

"This new generation of entrepreneurs has lots of energy and excitement about the decentralized future," he said.

These founders, according to Qureshi, need their investors to participate in token economics, go-to-market, product strategy, and hiring.

"That's why Dragonfly is often the first port of call for these entrepreneurs—unlike many of the generalist VCs, we've been doing this for many years now, we've backed many of the generational protocols and companies in this space, and we've seen the whole journey from seed to multi-billion dollar outcomes," Qureshi added.

The approach speaks to the breadth of crypto investors, which are becoming increasingly more hands-on with their portfolio companies and projects. Even newer market participants like Sequoia Capital have recognized the unique needs of crypto firms.

“Crypto moves so fast, crypto founders want to work with funds that can move incredibly fast, they want to work with funds that deeply understand their problems, deeply understand the landscape. Those properties are primarily going to live within crypto-specific funds rather than in generalist funds," Sequoia's Shaun Maguire noted in a recent episode of The Scoop.

As for Dragonfly, Qureshi said that the firm has a crypto-native team that "understands how these protocols work."

The fund was founded in 2018 by Bo Feng, an established venture capitalist with over 20 years of experience, and Alexander Pack, a venture capitalist who managed crypto investments and funding at Bain Capital Ventures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.