Goldman Sachs crypto survey shows 22% of respondents expect $100,000-plus bitcoin

Investment banking giant Goldman Sachs has posted the results of a survey on bitcoin and digital assets that suggests investors are bullish.

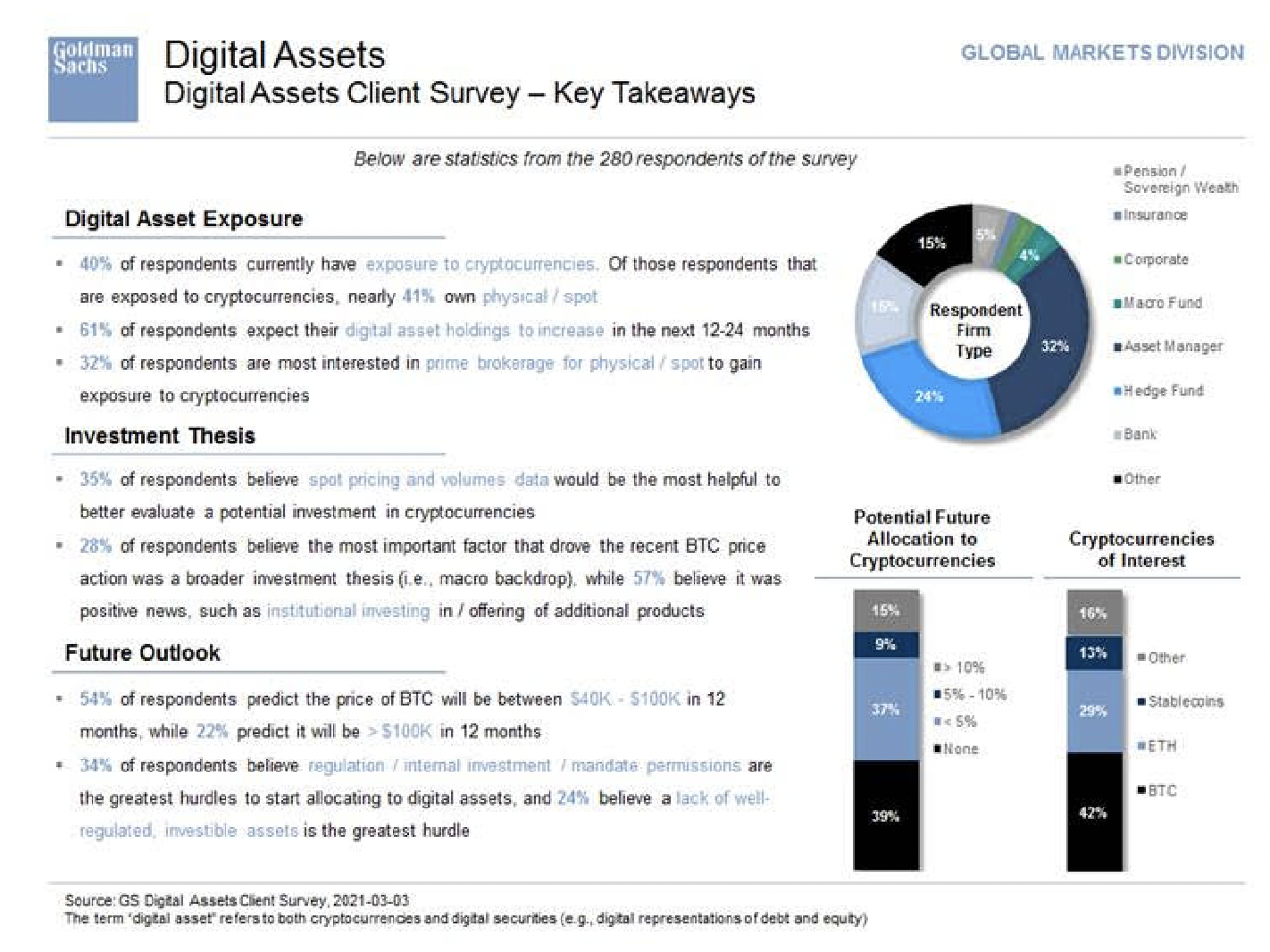

The New York-based firm, which operates a digital asset business within its markets division, surveyed a mere 280 clients on the topic of digital assets. The results—which were shared Thursday by Goldman Sachs' Max Milton—show that 40% have exposure to cryptocurrencies.

Meanwhile, more than 60% of those respondents expect their digital asset holdings to increase over the next 1 to 2 years. About 20% of respondents expect bitcoin to trade above $100,000 within the next 12 months.

Goldman Sachs appears to be reigniting its bitcoin trading desk operation, as The Block reported earlier this week.

The move comes as bitcoin's price flirts once more with $50,000. The bank first launched a bitcoin desk — which cleared futures and traded non-deliverable forwards — in 2018. But the firm apparently shut the desk down at some point.

Now the desk is set to re-open in mid-March, according to a source. It will not be trading bitcoin itself — at least to start. For now, it is trading derivatives tied to the asset and exploring how it can work with a third party custody provider to offer sub-custody for bitcoin.