Bitcoin dips below $48,000 as nearly $6 billion in crypto futures are liquidated

The price of bitcoin has dipped below $48,000 from nearly $57,500 on Monday as derivatives positions worth almost $6 billion get force liquidated by crypto exchanges.

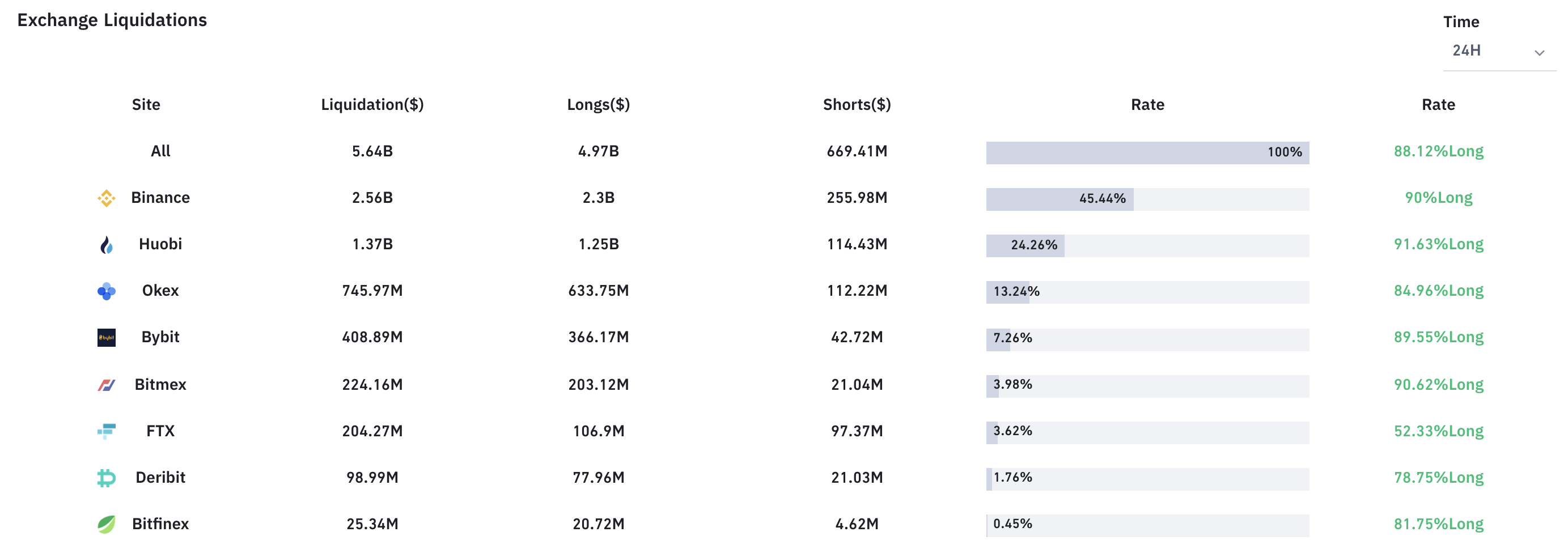

In the last 24 hours, $5.65 billion worth of open interest was liquidated by crypto exchanges, according to tracker Bybt.com. In other words, crypto exchanges liquidated traders' overleveraged positions.

Traders overleverage, or trade on margin, thinking that bitcoin's price would go up and they would benefit more. But when bitcoin's price goes below the liquidation price of their positions, exchanges force liquidate or close their positions because traders cannot fulfill margin requirements of their leveraged positions.

More than 645,000 traders were liquidated in the last 24 hours, and the largest single liquidation order happened on Huobi for bitcoin, valued at $20.66 million, according to Bybt.

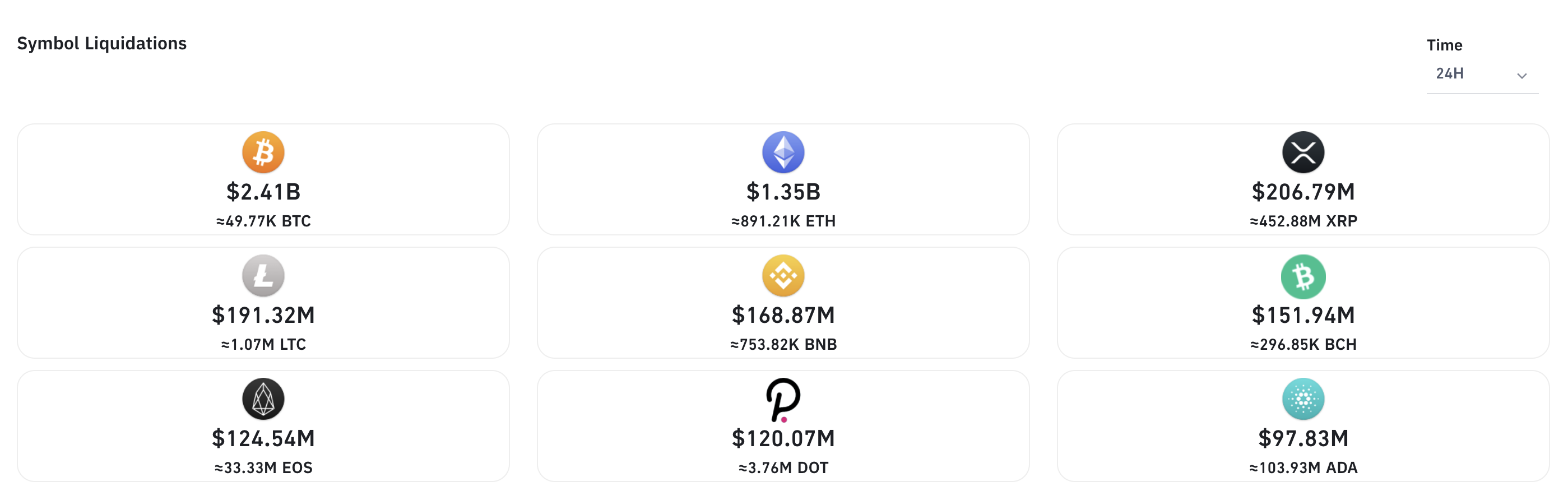

In terms of total liquidations across exchanges, Binance had the largest share (over $2.5 billion), followed by Huobi (around $1.40 billion) and OKEx (over $745 million). In terms of crypto assets, bitcoin positions formed most liquidations, followed by ether (ETH) and XRP.

The liquidations appear to the highest in crypto's history. Although the past data isn't immediately available, BitMEX's liquidations last year provide a good sense. BitMEX, the biggest crypto futures exchange at the time, saw over $700 million worth of liquidations then.

Bitcoin is trading at around $47,900 at the time of writing, according to TradingView.