BofA investor survey: Long bitcoin 'dethrones' long tech as the most crowded trade

For the first time since 2017, bitcoin was reported as the most crowded trade among investors surveyed in Bank of America's January Global Fund Manager Survey.

As per a report covering the survey, 36% of surveyed participants said that "long bitcoin" was the most crowded trade, followed by "long tech." "Long tech" and "Long US tech" had been the most crowded trades since the spring of 2020.

Bitcoin gained newfound interest among institutional investors in 2020, wooing investors ranging from Paul Tudor Jones to Anthony Scaramucci. Some institutional traders have described the asset as a possible hedge against inflation.

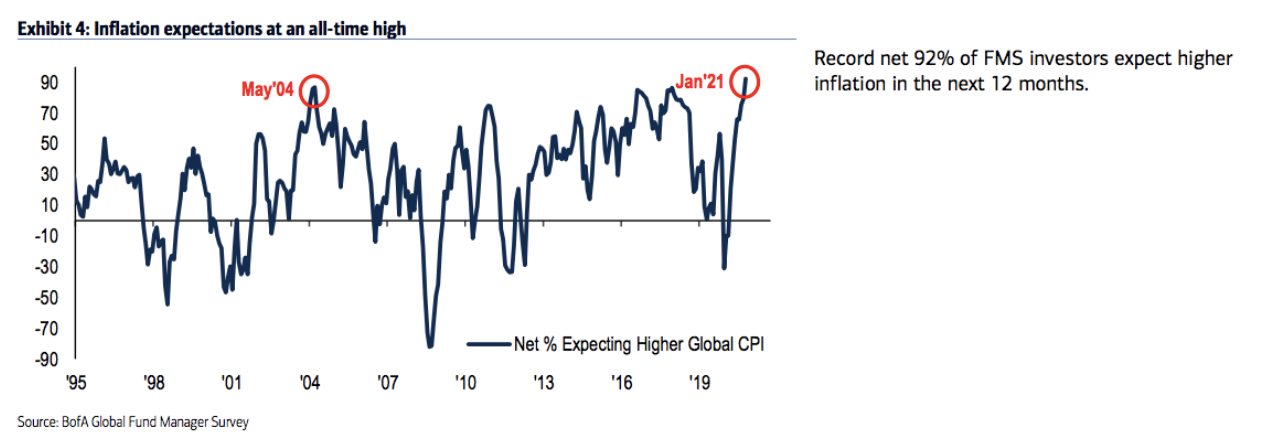

Indeed, inflation appears to be a growing concern for investors, according to BofA's report. A record net 92% of fund managers surveyed said they expect inflation to tick higher in the next 12 months — the highest level ever.