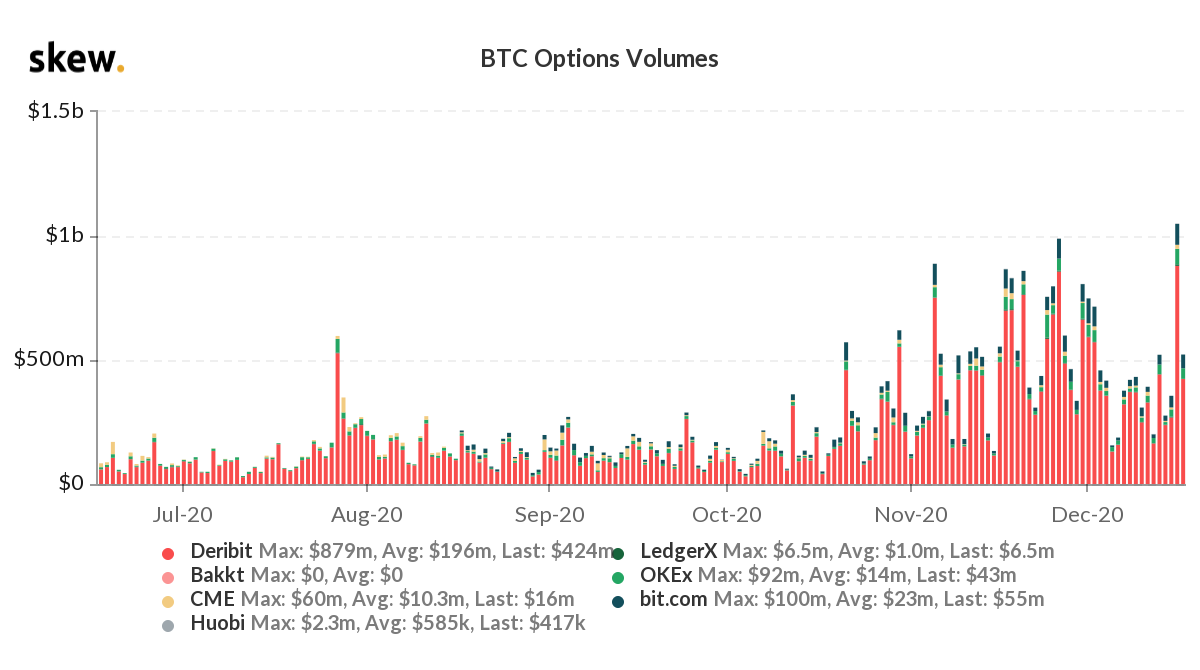

Bitcoin options' daily trading volume crosses $1 billion as bitcoin surges above $23,000

Bitcoin options' daily trading volume has crossed the $1 billion mark for the first time, as bitcoin surges past $23,000.

Crypto exchange Deribit leads the bitcoin options market, followed by Bit.com and OKEx, according to tracker Skew. Meanwhile, bitcoin is trading hands at around $23,550 on Coinbase, according to TradingView.

Deribit CEO John Jansen told The Block that it is "quite a special day" as all metrics have hit new all-time high records for the exchange — total open interest, total turnover, and total options turnover.

"We have seen a total turnover of $1.4 billion today (rolling 24 hours). Skew looks at calendar dates, so the market reached > $1 billion, but on Deribit alone, we traded more than that over the past 24 hrs," said Jansen. "We get a lot of demand for higher strikes and have just introduced a USD 100k strike for September 2021. BTC options market share remains very strong (80-90% volume and OI) as we have the best tightest spreads, deepest books, and most available series."