Lukka teams up with financial services giant IHS Markit to plug crypto data into Wall Street

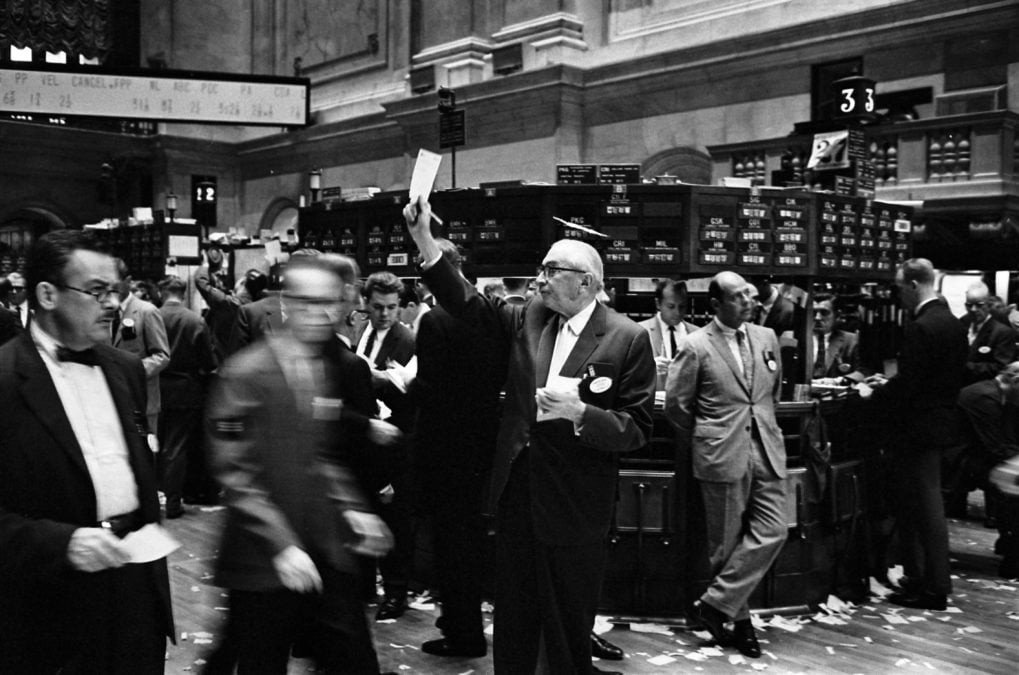

In a bid to woo institutional investors and large financial services firms to the digital asset market, crypto tax services and data provider Lukka has teamed up with information services giant IHS Markit to provide its data products to Wall Street.

In an announcement Wednesday, Lukka — best known for its retail crypto tax business — said the partnership would allow it to redistribute its flagship data through the NYSE-listed IHS Markit. Hence, Lukka's crypto data will join more than 23 million market data points that exist on IHS Markit's platform, which focuses on a range of assets from credit default swaps to municipal bonds.

Already, more than 160 crypto-native hedge fund clients leverage Lukka's software and data products, including Lukka Reference and Lukka Prime, which provides a single price for crypto assets, gleaning from several exchanges, over-the-counter trading desks, and wallets.

It's not exactly clear how many people on IHS Markit's platform will actually use Lukka's data or what the demand will be.

"I think it is probably a bit early to comment on that," Daniel Huscher, a managing director at IHS Markit, told The Block in an interview. "It's an exciting partnership, we want to be known as a company that's committed to innovation."

The access to Lukka's data would allow IHS Markit's asset management clients, for instance, to price crypto assets, thereby simplifying the post-trade and settlement process.

IHS isn't the first data provider to dabble with crypto. Financial data giant Bloomberg LP, for instance, teamed up with Mike Novogratz's Galaxy Digital in 2018 to launch a crypto index to track the performance of the largest cryptocurrencies. ICE, the parent company of the New York Stock Exchange, offers the ICE Cryptocurrency Data Feed through a partnership with Blockstream.

As for Lukka's tie-up with IHS Markit, Lukka's recently-minted CEO Robert Materazzi said it would be the first of many partnerships for the firm.

"You're going to see some press that aligns with what you're thinking," Materazzi told The Block.

"The traditional global custodians and fund admins have all been working on something with crypto and blockchain for some time. Direct conversations we are having with big logos shows [crypto] is finally touching their businesses instead of the innovation labs," he continued.