Executives at Korean exchange Komid sentenced to jail for faking volume

Korean authorities sentenced two executives at Komid, a South Korean cryptocurrency exchange, to jail terms on January 17 for their role "in orchestrating fraudulent trading volume" as reported by Blockinpress. CEO Hyunsuk Choi received 3 years another executive, named Park, received 2 years.

Choi and Park allegedly created five accounts through which they were able to fabricate 5 million transactions. According to the court documents, the faked volume deceived both investors and new users, which led to Choi and Park earning about $45 million in fees.

The judge said that "the crime has damaged customers’ confidence in the virtual currency exchange and has had a negative effect on the domestic virtual currency trading market." This was the first time that a cryptocurrency exchange executive received jail time for faking volume. Wash trading, the creation of artificial trading activity, is a common practice in the cryptocurrency space.

Blockchain Transparency Institute, a team of blockchain data researchers, released a report in December that showed clear evidence of wash trading across 80% of pairs on 95% of exchanges. There are some firms that are selling services to token teams and exchanges to inflate volumes, according to marketing materials reviewed by The Block.

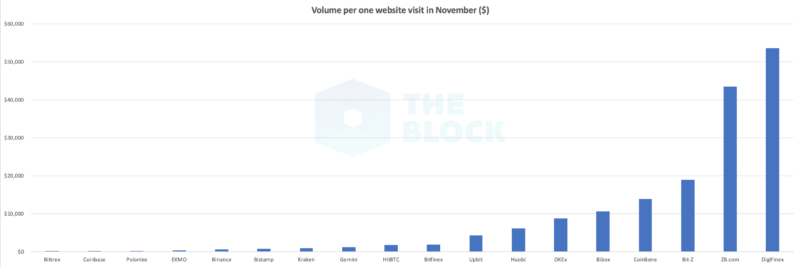

An analysis by The Block found that the volume per one website visit could potentially be a significant metric in identifying faked volume.

South Korea has an active cryptocurrency ecosystem but it is also amongst the most actively regulated countries regarding cryptocurrencies. If all the exchanges that fake volume were criminally prosecuted, the implications for the crypto ecosystem could be very large.