SEC filing shows that Uniswap raised $11 million in June

UPDATE 5:20 P.M. EST: In a blog post, Uniswap confirmed that it raised $11 million in a Series A funding round.

The round was led by Andreessen Horowitz along with Union Square Ventures, Version One, Parafi Capital, Variant, SV Angel and A. Capital. Paradigm, which participated in Uniswap's 2019 seed funding round, also took part in the Series A.

"This investment round will help us grow our team to build Uniswap V3, which will dramatically increase the flexibility and capital efficiency of the protocol," Uniswap said in its blog post. "We can’t wait to present our design to the Ethereum community in the coming months."

A Form D filing submitted to the U.S. Securities and Exchange Commission in June indicates that the company behind decentralized exchange Uniswap raised $11 million from a group of as-yet-to-be-identified investors.

The June 19 filing, flagged on social media Thursday morning, indicates that the first sale of the $11 million in securities was sold on June 5. The filing indicates that the $11 million was raised from 12 investors, though it's not clear whether the filing reflects the total amount Uniswap may have raised in this particular funding effort.

The influx of new funding came about a month after Uniswap launched the second iteration of its decentralized exchange, Uniswap v2.

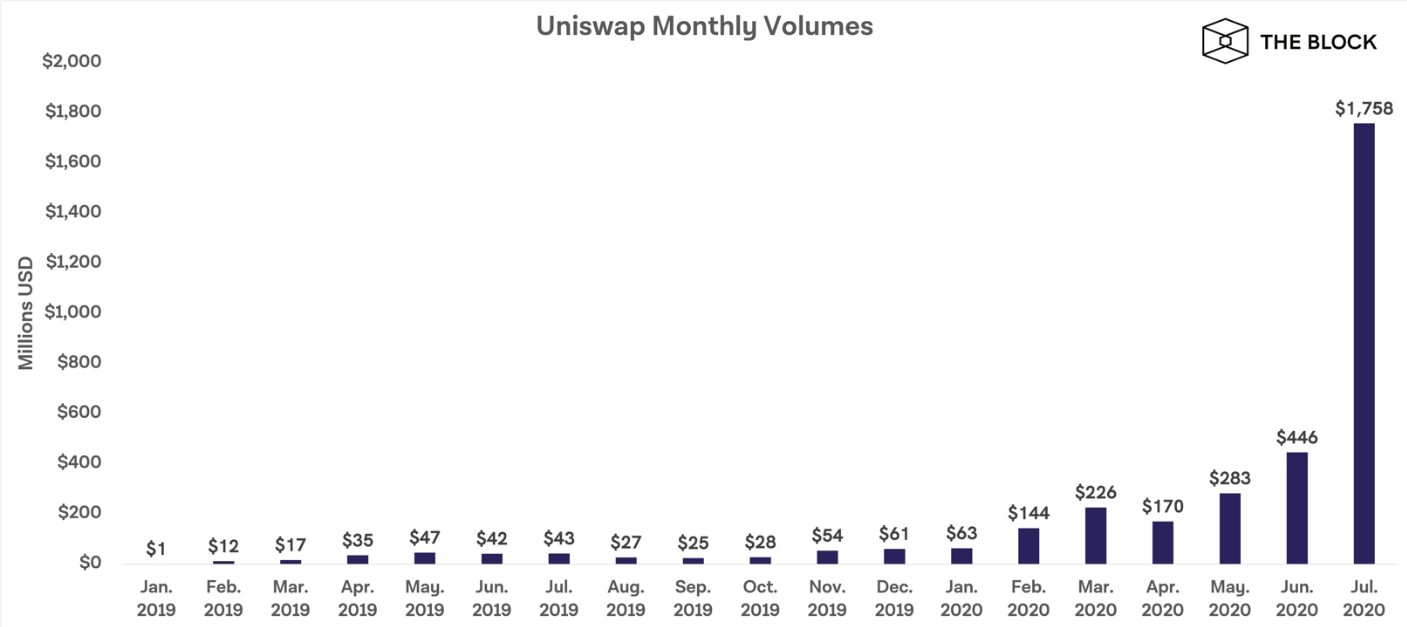

DEX volume surged to a record-breaking high of $4.3 billion during July, with Uniswap accounting for 41% of that traffic. Uniswap itself has been experiencing upward volume growth in recent months.

The DEX-to-centralized exchange ratio rose to nearly 4% during that period, a monthly high.

Uniswap did not immediately respond to a request for comment.

This report has been updated with additional information and confirmation that Uniswap raised an $11 million Series A funding round.