Bitcoin's correlation to stocks has declined significantly

Bitcoin’s correlation to stock index S&P 500 has declined significantly, hinting that the two asset classes no longer move in the same direction.

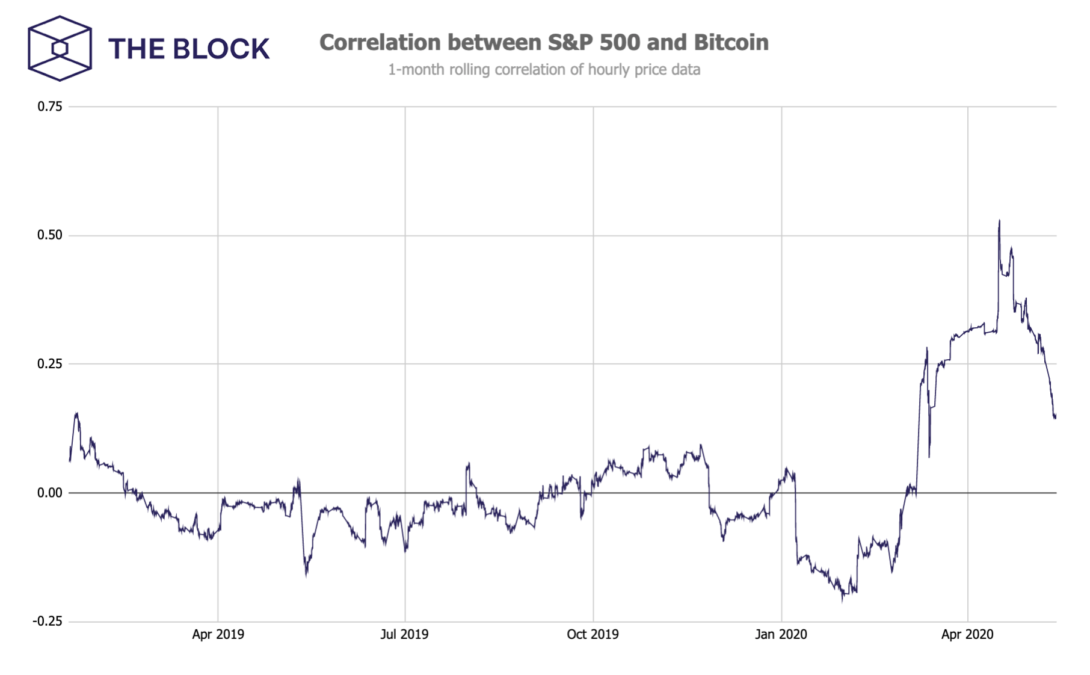

The correlation between bitcoin and S&P 500, measured via BTC/USD on Coinbase and S&P 500 futures, has touched a two-month low.

The current correlation between the two asset classes is 0.15, which means it is nearly negligible. About a month ago, on April 16, the correlation was moderately positive at 0.53.

A near-zero correlation between two assets indicates that there is no relationship between them or that they do not move in the same direction.

Correlation is expressed as a number between +1 and -1. +1 indicates an absolute positive correlation between two assets, meaning they always move together in the same direction. -1 indicates a total negative correlation, meaning two assets always move in opposite directions of each other.

Having two low-correlated or uncorrelated assets in a portfolio helps lower overall volatility.