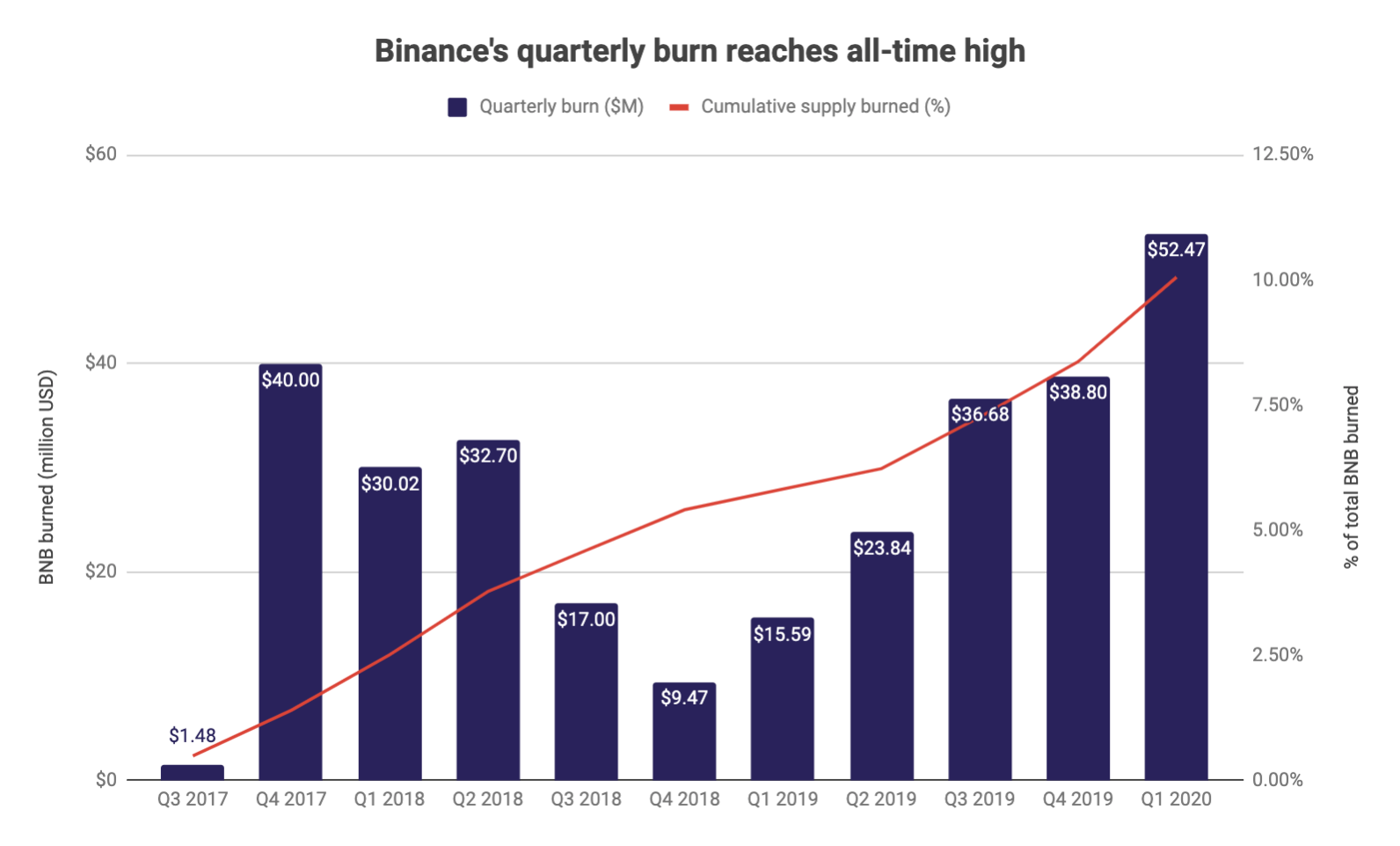

After record Q1, Binance has cumulatively burned 10% of BNB's supply

Crypto exchange Binance has today completed the 11th quarterly burn of its BNB tokens.

Binance has burned $52.5 million worth of BNB in Q1 of 2020, a 35.2% increase from $38.8 million in Q4 of 2019.

The Q1 BNB burn is the largest burn Binance has ever made - both in terms of BNB and USD. Binance has so far burned a total of 20.12 million BNB (an equivalent of $298 million) in 11 burn events, which represent about 10.1% of the total supply of 200 million.

Notably, Binance no longer burns BNB based on its profit but does so based on its self-reported volumes.

Historically, Binance’s revenue has been mainly transactional, meaning that it has relied on spot trading volume. According to The Block Research, Binance has recorded its second-best quarter yet in terms of spot trading. Its spot volume has grown by nearly 91% in Q1 to over $150 billion as compared to $80 billion in Q4. The futures volume has also seen sustained grown month-to-month and grew by nearly 190% in Q1.

To read the full analysis and more such data-driven stories, subscribe to The Block Research.