Major Chinese insurer subsidiary OneConnect's $500M IPO fizzles

OneConnect Financial Technology, the blockchain and artificial intelligence arm of one of China’s biggest insurers Ping An Insurance, today launched a $500 million U.S. initial public offering (IPO) at a much lower valuation than anticipated.

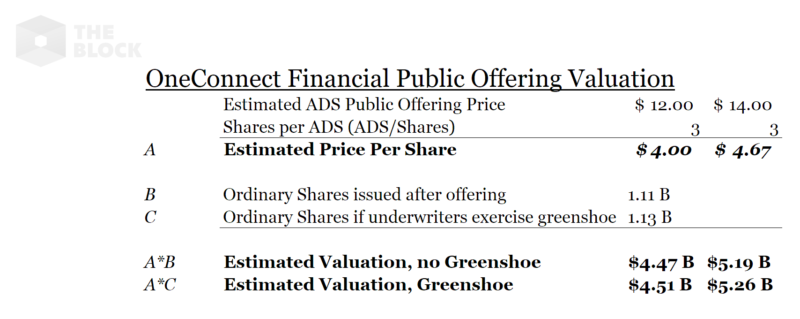

According to the updated SEC filing, OneConnect is selling 36 million American depositary shares (ADS) at a unit offering price between $12 and $14. A number of banks including Goldman Sachs, JPMorgan, and Morgan Stanley worked on the IPO. Trading is due to begin on Dec. 13 on the New York Stock Exchange under the symbol “OCTF.”

The deal puts OneConnect’s valuation between $4.5 billion to $5.2 billion, according to The Block's calculations, which marks a sharp drop from its $7.5 billion valuation in February 2018 when it raised $650 million from investors including SoftBank and SBI Group.

Founded in 2015, OneConnect offers tech solutions to small- to medium-sized financial institutions including artificial intelligence, blockchain, cloud platform, and biometrics identification solutions. It generated a revenue of $218 million in the first three quarters of 2019, a 72% increase from the previous year, Reuters reported.

The company was initially expecting an IPO of $1 billion and a valuation of $8 billion, sources told Reuters in June. It even changed the listing venue from Hong Kong to New York in order to steer clear of market instability in Hong Kong amid the ongoing anti-government protests, hoping to score a higher valuation, Reuters’ article says.

In recent months, investors have witnessed tech companies such as WeWork and Uber fall considerably in value. They are now ready to push back on valuations and deter companies’ fundraising ambitions, Bloomberg speculates, which could have contributed to OneConnect’s down round.