Hedge funds were net short CME bitcoin futures going into this downturn, CFTC report shows

Some hedge funders out there appear to have made a stronger bet on the short side of the CME bitcoin futures market over the past week, data from the Commodities Futures Trading Commission shows.

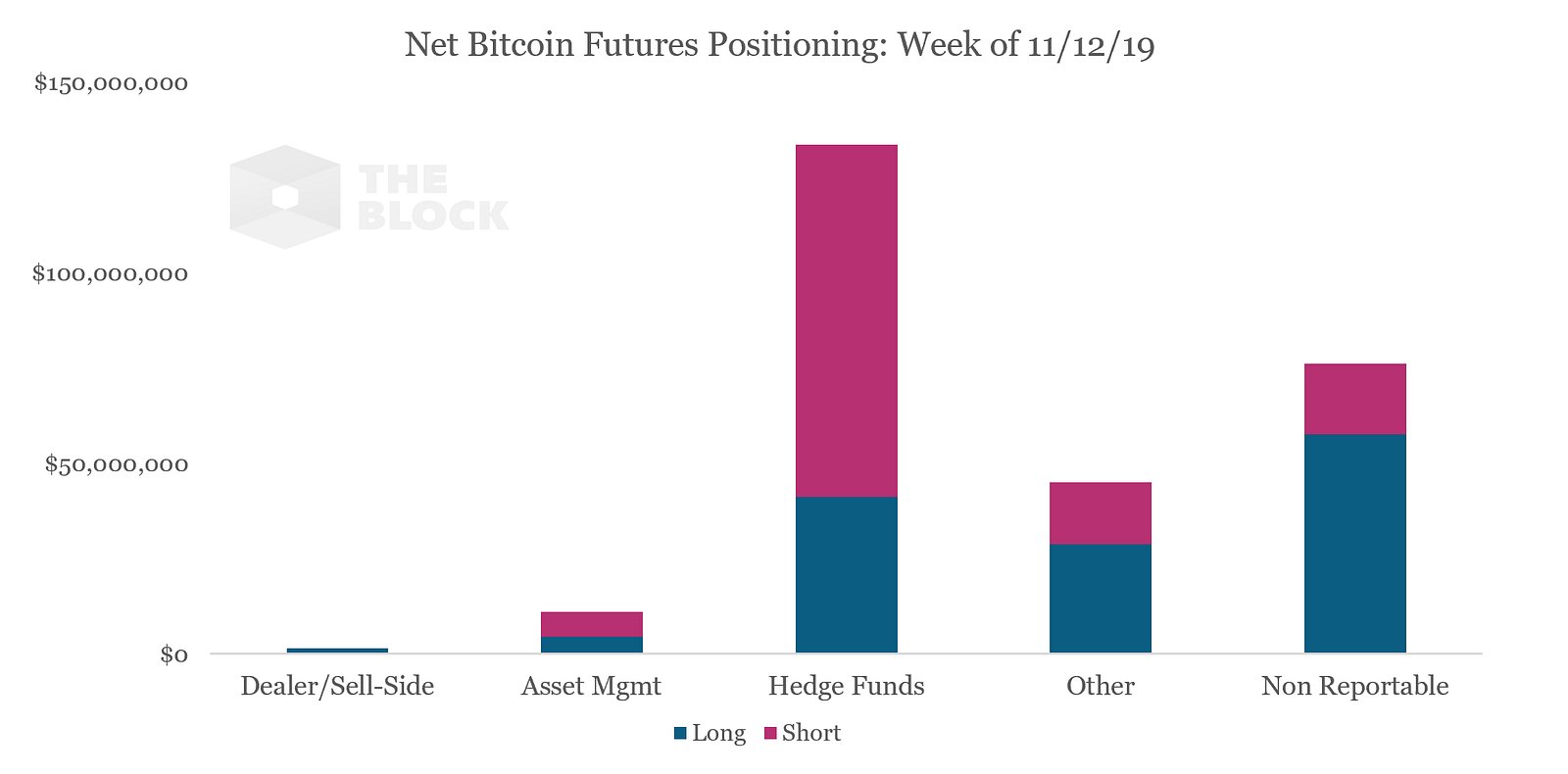

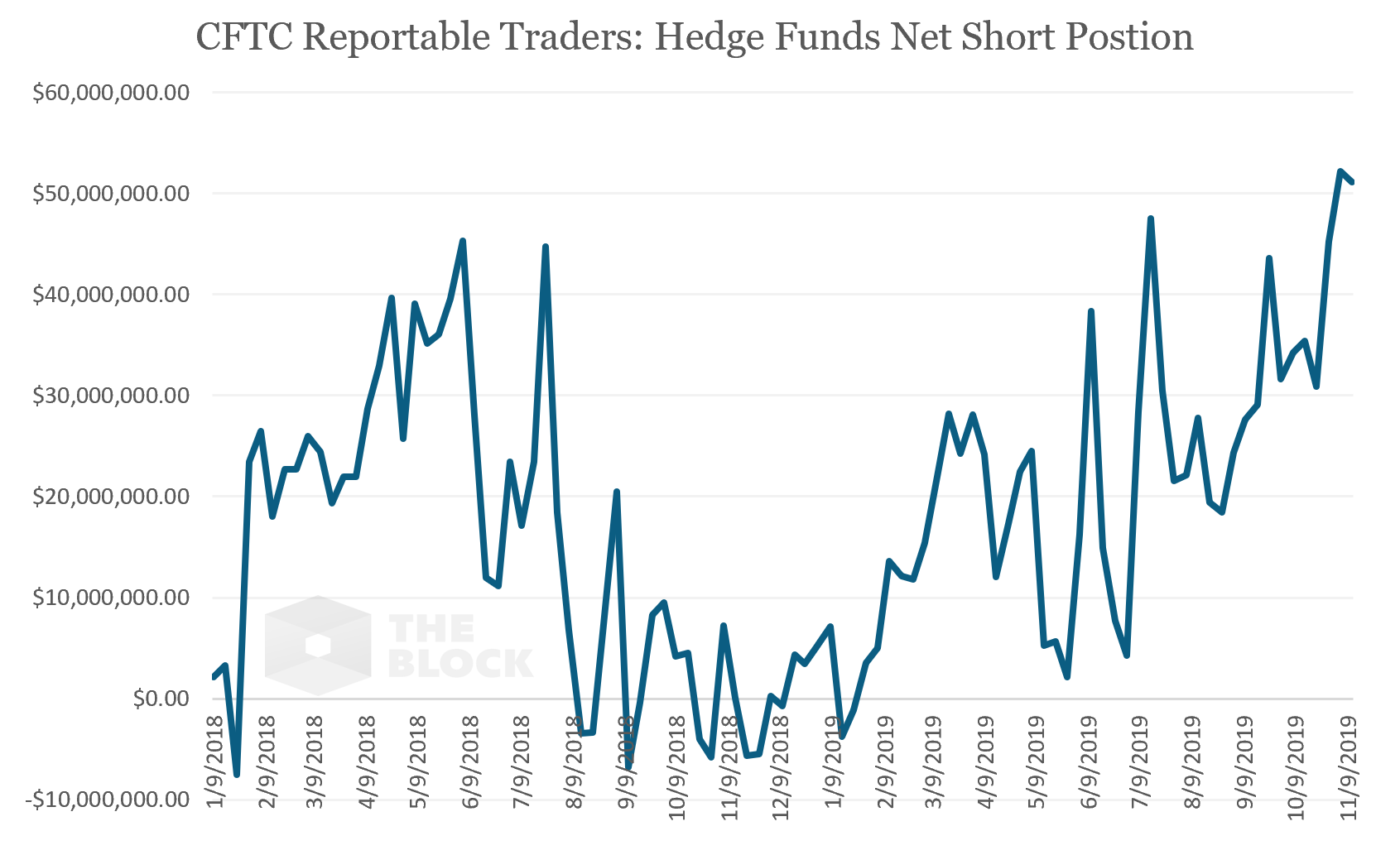

As per a research report by The Block's Ryan Todd, hedge funds were overwhelmingly short during the week of November 12th compared to the sell-side, asset managers, and other groups. Specifically, net short positioning (Short OI - Long OI) among hedge funds that trade the CME bitcoin product was at an all time high over the last two weeks of COT report prints.

Here's the chart:

To be sure, the data only shows net positioning of CME bitcoin futures; funds could still be exposed to the underlying spot on the long side and using bitcoin futures to hedge out risk.

At last check, bitcoin was trading down 19.55% from $8,806 on November 12 at around $7,085 on Sunday. If those funds closed their position, that would have left them with some profits from the dip.

The short position, according to Todd, was significant given sentiment throughout the second quarter of 2019. Here's Todd:

"This is notable as throughout 2Q19, hedge funds have been relatively net neutral, while asset managers and non-reportable traders skew heavily long (>80%); while Other traders have been net short (most likely operating in a dealer/sell-side capacity in making markets?)."