Nearly 10% of India's richest investors are looking to increase allocation to cryptocurrency

India's richest investors are looking to ramp up their allocation to cryptocurrencies, as concerns about a slowdown in the economy grip the nation.

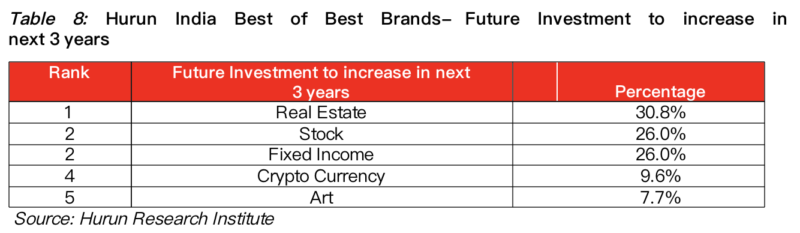

As reported by Quartz, about 36% of India's high-net worth individuals are pessimistic about the Indian economy over the next three years, citing data from Hurun Report. That fact is pushing them to invest in safer and alternative assets, namely real estate. A similar percentage of people say they are avoiding risk altogether when it comes to their future investing.

Still, despite the desire for risk-off assets, 9% of wealthy Indians said they would increase their allocation to cryptocurrencies over the next three years.

Nearly half of the respondents said they don't know much about virtual currency, per the report. Among those who were educated about it, the largest group indicated a preference to invest in Bitcoin (29.15%); the next 8.74% preferred Ethereum and 6.80% would like to invest in Ripple.

Still, the volatility of cryptocurrencies, including bitcoin, could prevent it from becoming a so-called safe haven asset class, as noted by The Block's Ryan Todd.

"Looking at average 30-day rolling volatility, bitcoin has seen an average 12.4% annualized 30-day volatility over the last five years, and currently sits just under 20%. Compare that to treasuries at ~.50%, and even the S&P 500 and gold at 2.5%, and you can see why there was a collective push-back on the notion that bitcoin offers 'safety,'" Todd wrote in August.