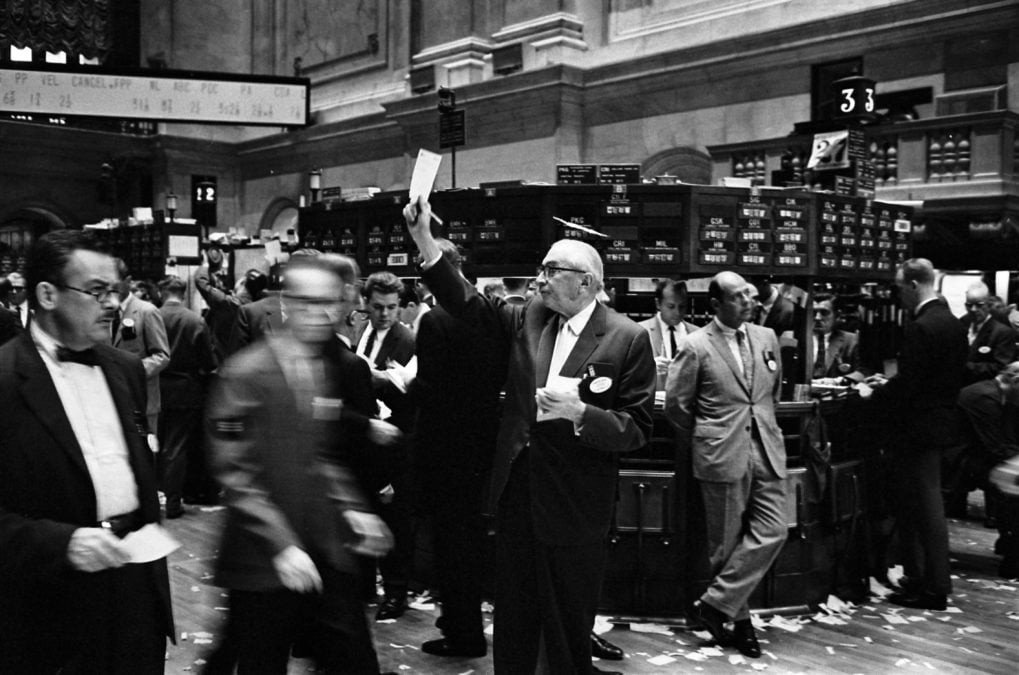

Market data snafu presents headaches for traders during wild week

Adding to the anxiety that gripped Wall Street this week, traders also had to deal with a data glitch that rippled through the market, according to a report by The Wall Street Journal.

Since President Donald Trump announced the U.S. would impose 10% tariffs on China, the markets have shed more than 4%. On Wednesday, the markets saw some of their biggest losses this month.

RELATED INDICES

At the beginning of the week, however, a glitch on a data feed run by New York Stock Exchange caused what "looked like calamitous drops in Vanguard Group mutual funds," as well as pricing for certain stocks on the Bloomberg Terminal, The Journal reported.

"At one point, the site showed the Vanguard Wellesley Income Fund down 56% and the Vanguard Target Retirement Income Fund down 46%," The Journal wrote.

According to The Journal, more than 20 indexes were impacted by the glitch, which NYSE declined to comment on. The data issues continued into Tuesday with the S&P 500 standing still for 13 minutes during the afternoon trade. The erroneous data impacted numerous trading firms and mutual funds, according to Christopher Nagy of Healthy Markets Association.