Cryptocurrency investors start receiving letters from the IRS

The Internal Revenue Service (IRS) has begun sending letters to over 10,000 U.S. cryptocurrency investors last week, asking them to report their crypto holdings and pay taxes properly. The IRS said that the names of these taxpayers "were obtained through various ongoing IRS compliance efforts."

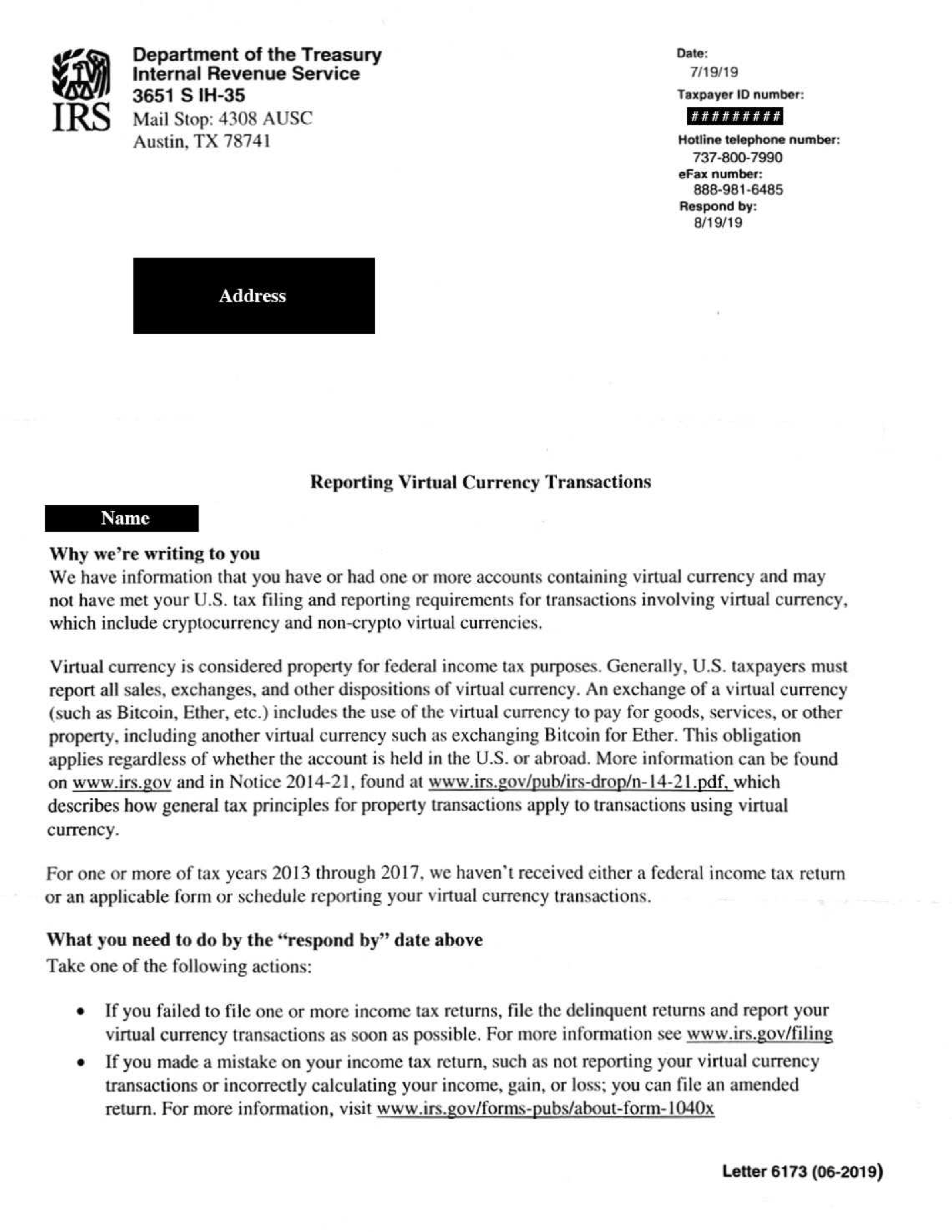

There are three variations of the educational letter (6173, 6174 and 6174-A), all of which are supposed to help taxpayers understand their tax and filing obligations and how to correct past errors.

Letter 6174 and 6174-A are no-action letters, which means that if all the obligations have been met, there is no need to respond. The taxpayers could receive these letters despite being fully compliant. Letter 6173, on the other hand, alleges noncompliance and requires action. If there is none, the tax account will be examined by the IRS. The Block has obtained Letter 6173, which can be seen below.

The full 'Letter 6173' can be viewed and downloaded here.