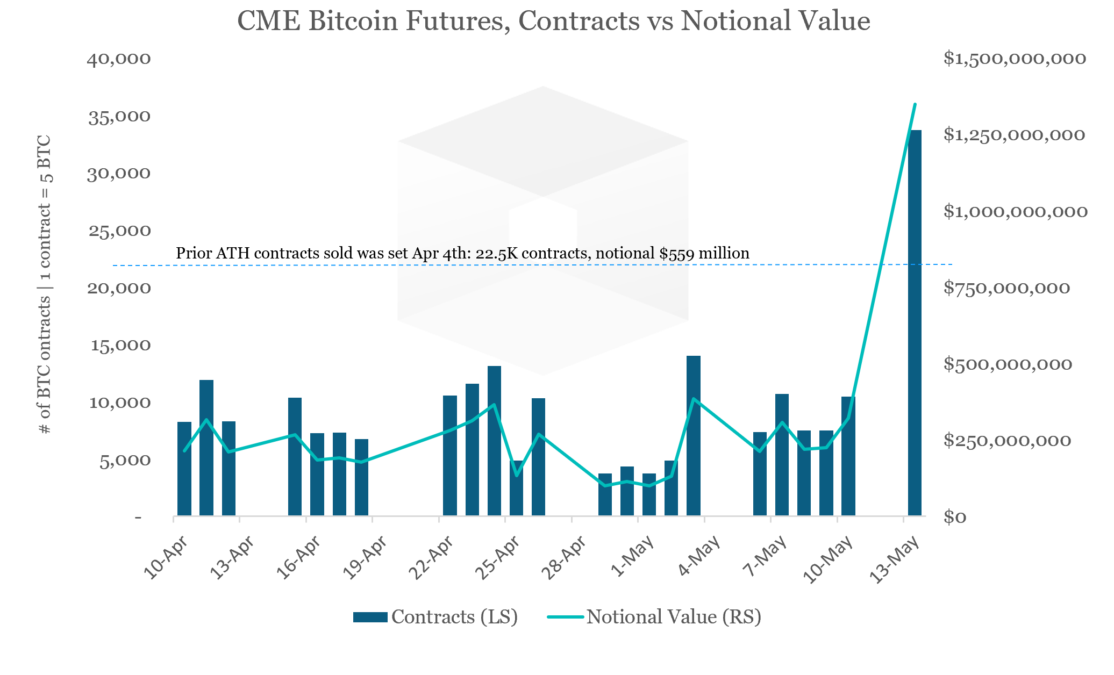

CME Group clocks bitcoin futures volume record by an eye popping 50%, with more than $1 billion in notional value traded

In a day that saw the price of bitcoin reach 10-month highs, and the amount of bitcoin inflows added to Grayscale's trust product reach all-time highs signaling rising institutional demand, it was CME bitcoin futures that punctuated the extent of an institutional driven rally.

Reported in a desk update tweet from CME Group, the world's largest options and futures exchange, the Chicago exchange declared its bitcoin futures product recorded a new all-time record of 33.7K contracts sold in one day — shattering the prior records of 22.5K and 18.3K set on Apr 4 and Feb 19, respectively.

RELATED INDICES

Considering each contract is equal to 5 bitcoins, the total notional value of 33.7K contracts equates to more than $1 billion in total value traded, and more than 168K worth of bitcoins. According to data from Bitwise, which adjusts reported bitcoin spot volumes to account for fake volumes, the $1 billion plus worth of CME bitcoin futures volumes in the prior 24 hours was almost double the bitcoin spot volume on Binance and triple volumes on Coinbase.

May 13th notional value is calculated as 168,385 bitcoins * an assumed $8,000 price