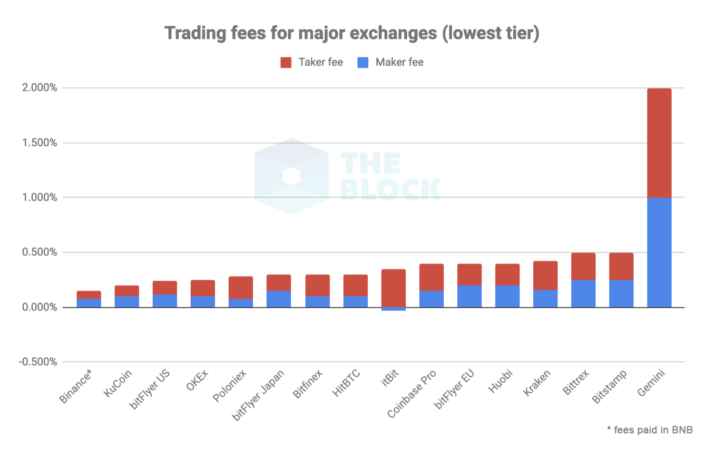

Gemini has the highest trading fees for retail, and its competitors aren't even close

Crypto exchanges have long been the big money makers in the nascent digital asset market, charging hefty fees on making a trade relative to exchanges and brokers in U.S. equities.

But one market player is charging its retail clients dramatically more than the competition, as per research by The Block's Research Editor Larry Cermak. Looking at the lowest tier, which includes the vast majority of retail customers, Gemini has the least favorable combined fees for retail customers, Cermak wrote. Gemini's fees come in at a whopping 2%, or 200 basis points.

Meanwhile, Binance has the lowest combined trading fees; followed by KuCoin and bitFlyer US. The average combined fee of the lowest tier is 0.44%.

itBit is the only exchange in the lowest tier that offers a negative maker fee, which means that traders actually get a rebate by posting liquidity to the order book. The average maker fee of the lowest tier is 0.19%.

RELATED INDICES

As The Block previously reported, industry insiders expect fees to compress as competition continues to heat up in the crowded industry.

“Compression will come from supply and demand. I fully expect crypto to trend toward Equity and FX commission models in the next decade,” David Mercer, CEO of crypto trading platform LMAX Digital, said. “Current retail led fee schedules are not sustainable in an institutional capital market. Investors and real money clients will expect added value for high fees not just simple matching of orders and access to liquidity," he added.

TAGS