Crypto traders fret an overheated futures market amid fall in spot prices

The cryptocurrency market has shed billions of dollars in aggregate market cap amid a macro-driven rout, but traders are worried that an overheated futures market suggests that prices could fall further.

The total market capitalization fell from a high Wednesday above $2.2 trillion to a low of $2.02 trillion early Thursday morning, with bitcoin falling more than 7% and ether sinking more than 12%. These moves were potentially driven by broader macro forces, specifically The Federal Reserve's indication that it may raise interest rates sooner than previously expected.

"The market is basically being driven by outside forces more so than crypto-specific positioning and fundamentals," commented GSR's Richard Rosenblum.

Still, despite the market gyrations, liquidations were relatively muted compared to other market drawdowns that have seen a cascade of liquidations push the price down even further. Will Clemente, a well-followed commentator in the crypto market, mused: "What is this, a liquidation cascade for ants?"

Indeed, data from The Block shows there were just $75 million in long liquidations on Wednesday.

RELATED INDICES

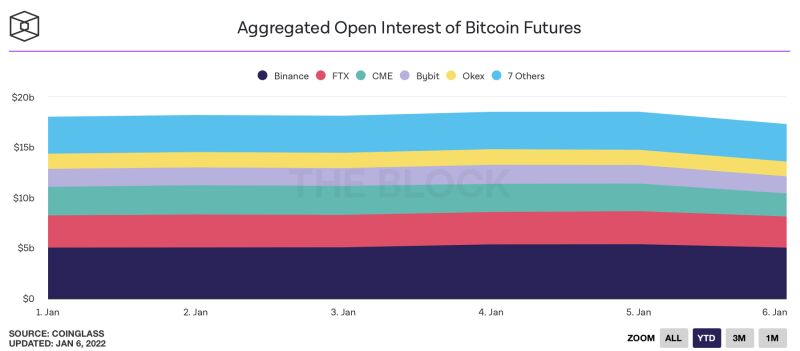

The juxtaposition of low liquidations and high open-interest (the amount of outstanding futures positions in the market) suggests there's "tons more OI to wipe out," according to one trading source.

Indeed, open interest across futures markets slid modestly between the fifth and sixth of January, falling to $17.28 billion.

Still, high open interest and muted liquidations don't necessarily mean the market "nukes further," but a macro catalyst could trigger a market event that drives the price down, hitting traders' stops and liquidating them.

"We’re seeing [traditional finance] firms capitulating on the Kazakstan news while crypto native firms continue to live in fear of Fed hikes," said Josh Lim, head of derivatives for Genesis. "Although $1bn of open interest was liquidated on the move to $43k, there will be far more damage below $40k where more levered long stops live."