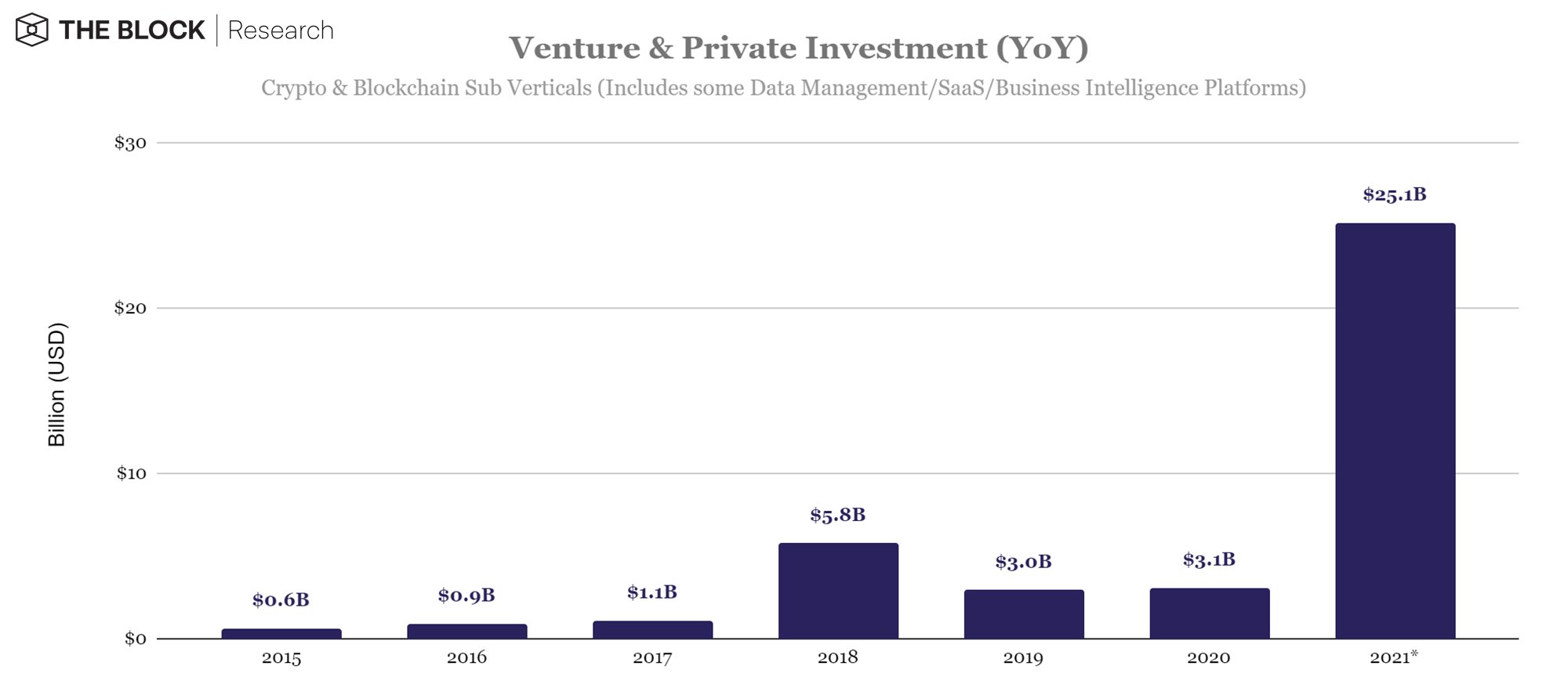

Crypto companies raised just over $25 billion in venture funding during 2021

Just over 1,700 venture capital deals focused on the crypto space occurred in 2021, netting these startups, projects and protocols some $25.1 billion in financing.

Compared to 2020, the new figures represent a 126% increase year-over-year in the number of deals and a 719% increase year-over-year in total funding. These findings were included in The Block Research’s 2022 Digital Asset Outlook Report.

As The Block has reported in its funding deal coverage, numerous crypto companies achieved so-called unicorn status – that is, scoring valuations above $1 billion.

Per The Block Research’s findings, at least 65 companies achieved this distinction during 2021. On a two-year horizon, that represents a 491% increase.

Recent unicorn-status funding rounds include FTX, Alchemy, TaxBit and Dune Analytics. Other well-known companies, including Binance and its US-based offshoot, are also said to be raising at multi-billion-dollar valuations.

Read the full 2022 Digital Asset Outlook Report here.