DEX aggregator 1inch blocks out US trades in preparation for separate American platform

As of September 29, the decentralized exchange aggregator 1inch has begun geofencing U.S. IP addresses.

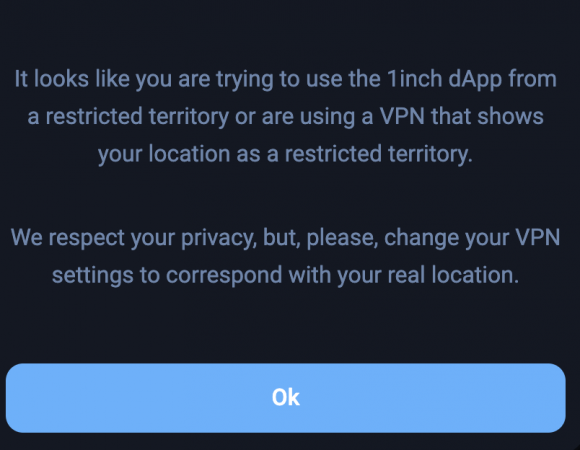

Source: 1inch

Though the platform's terms of use have apparently restricted U.S. users since April, that restriction has only recently come online on a technical level.

When reached for comment, Sergey Maslennikov, chief communications officer of the 1inch Network, told The Block that "Today we've just added one more pop-up notification and technical layer to control this."

The move aims to pave the way for a new product to launch in the U.S. The representative wrote:

"The 1inch Network is in the process of collecting the Series B funding round that has now grown to $175M (instead of $70M as was planned before). A significant part of these funds will be used for the development and launch of the 1inch Pro product which is specifically designed for the US market and for global institutional investors in accordance with all the regulatory requirements."

Per data from The Block, 1inch is the dominant DEX aggregator on the market, accounting for almost two-thirds of overall volume.

U.S. regulations are relatively stringent on what sorts of investments are available to U.S. users, particularly without the provision of know-your-customer information. Decentralized exchanges and aggregators like 1inch often don't require more information than a wallet address. Though a number of international exchanges limit U.S. (and other jurisdictions') access to their platforms, decentralized exchanges have been less apt to do so.

Such geofencing is notoriously simple to circumvent using VPNs.

The degree of regulatory scrutiny is changing DeFi, however. Earlier this summer, leading DEX Uniswap delisted a host of tokens that resembled securities or derivatives offerings, a move that came as the Securities and Exchange Commission began to devote more attention to the DeFi space.