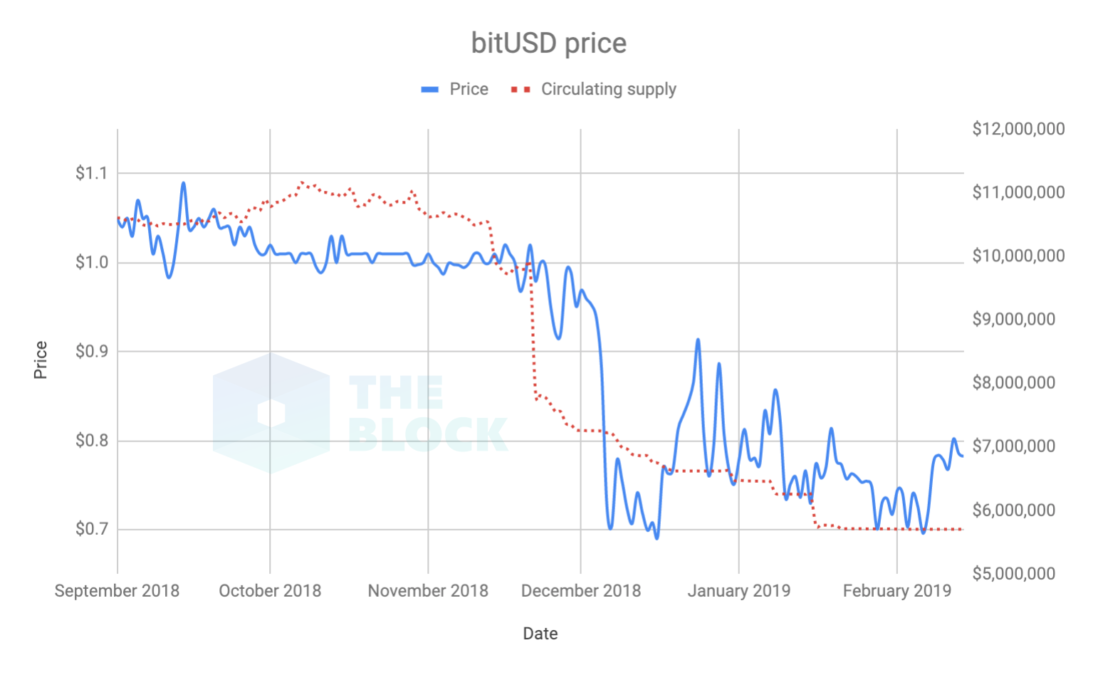

BitUSD hasn't had its $1 peg for more than two months

BitUSD, the earliest mainstream stablecoin launched in July 2014, lost its peg with the US dollar in November 2018 and hasn't recovered since. BitUSD was designed as the native currency of a platform launched by Daniel Larimer and Charles Hoskinson BitShares. It is collateralized by BitShares tokens.

As BitMEX Research pointed out, BitUSD had a flawed price stability mechanism since it only protects against the scenario where the value of BitShares falls and not when the value of BitUSD falls. The mechanism to hold the $1 peg was psychological.

On Nov. 25 2018, BitUSD triggered an emergency procedure called 'global settlement' because bitUSD was too under-collateralized by BitShares. The event caused a disablement of BitUSD borrowing and the price of BitUSD subsequently collapsed. The circulating supply has also been nearly cut in half in the last four months.