LMAX Group to sell stake to New York private equity firm, valuing firm at $1 billion

JC Flowers & Co, the multibillion-dollar private equity firm, is set to acquire a 30% stake in cryptocurrency and FX exchange operator LMAX Group.

The deal — first reported by the Financial Times — is still subject to regulatory approval, but it would value LMAX at $1 billion, the announcement said. LMAX will work with the New York private equity firm to "accelerate the company's next phase of growth and innovation," a media release said of the deal. Per the FT's report, LMAX was valued at £100 million in 2018.

"They share our DNA," Mercer said in an interview with The Block, referring to JC Flowers. "They are going to help us propel ourselves forward and accelerate our growth...they share our vision of creating the leading crypto and FX business."

The deal won't provide LMAX with additional cash, but the firm plans to lean on JC Flowers to connect into new geographies where they have a presence, Mercer said. JC Flowers is run by J Christopher Flowers, who previously spent nearly 20 years at Goldman Sachs and was one of the youngest partners in the firm's history.

J.C. Flowers is set to have 2 board seats.

LMAX has been operating in the FX market since its earliest days and was founded in 2010. The firm moved into cryptocurrency trading with the launch of LMAX Digital in 2018.

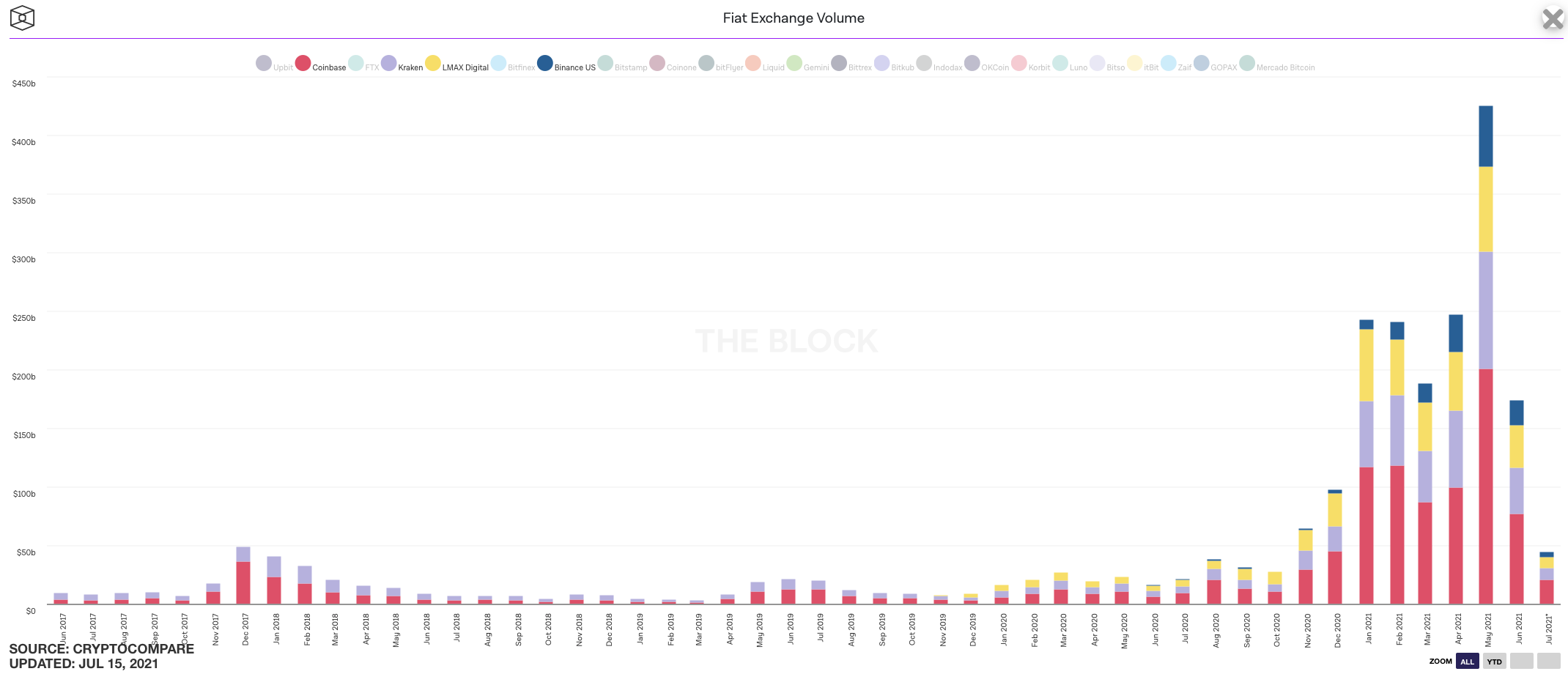

LMAX Digital is among the largest exchanges in the cryptocurrency market, clocking in $36 billion worth of volumes last month, according to The Block's Data Dashboard.

As for what LMAX is eyeing next, the firm is keen on expanding its product offerings on both the FX and crypto sides of the housing, currently exploring new derivatives in FX such as forwards and swaps, Mercer said. In crypto, the firm could support more trading options, including stablecoins.

"We genuinely think we are just getting started," Mercer said.

This post has been updated following a conversation with LMAX's David Mercer.