Canadian investment bank says Bitcoin is becoming more decentralized

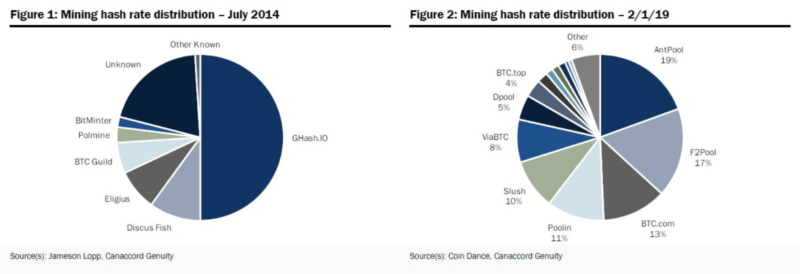

According to a report from Canadian investment bank Canacord Genuity, Bitcoin is becoming more decentralized. The report cites a reduction in the Herfindahl-Hirschman Index (HHI) — a market concentration measure — as well as no mining pool controlling more than 20% of the hash distribution (vs GHash controlling ~50% in mid 2014) as an indication of less centralization.

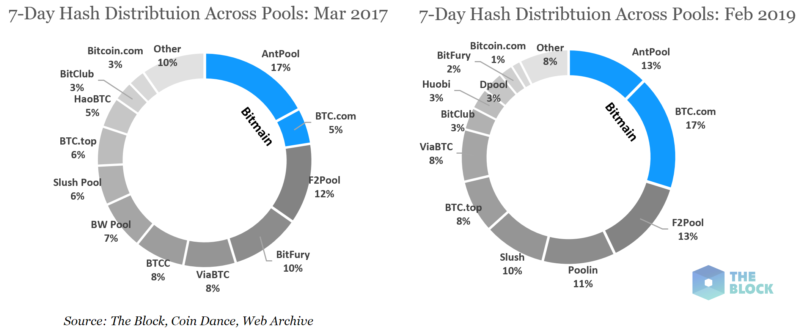

However, contrary to stories that other publications have pushed, the research omitted the fact that Bitmain owns both Antpool and BTC.com mining pools (with an indirect investment in ViaBTC), combining for over a third of the network hashrate. Bitmain aside, the distribution of singular mining pools making up no more than ~20% has been the case since GHash pool dominance waned, as data from the ledger in 2017 confirms.