There have already been twice as many large-scale crypto VC deals in 2021 than there were in 2020

There were twice as many crypto venture capital deals larger than $50 million in the first quarter of 2021 than there were in all of 2020, according to The Block Research.

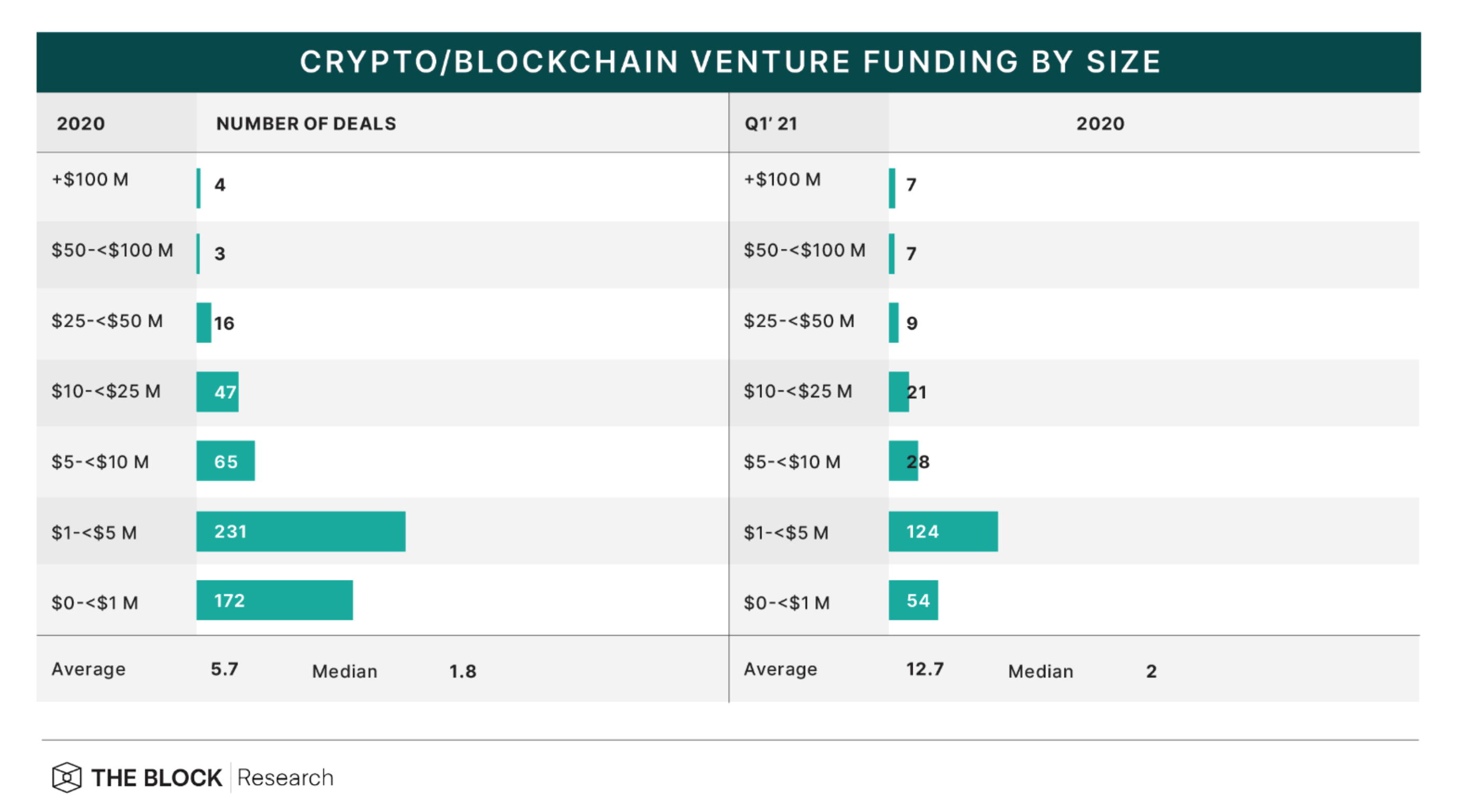

Last year there were four crypto venture capital deals worth more than $100 million, and three deals worth between $50 million and $100 million.

In Q1 of this year, there were seven deals of $100 million or more: BlockFi, NYDIG, Dapper Labs, FireBlocks, Blockchain.com (twice). Seven more were worth $50 million to $100 million.

These large-scale deals were enough to push the average deal size from $5.7 million in 2020 to $12.7 million in the first few months of 2021.

To get more of an overview private funding of crypto and blockchain projects in Q1 ‘21, check out The Block Research.