Ether options traders eye calls above $3,600 for June expiry

Quick Take

- The distribution of June-expiry ether options implies that derivatives traders are focused on calls above $3,600.

- The most popular strike price for end-of-June calls is $6,500, according to an analyst.

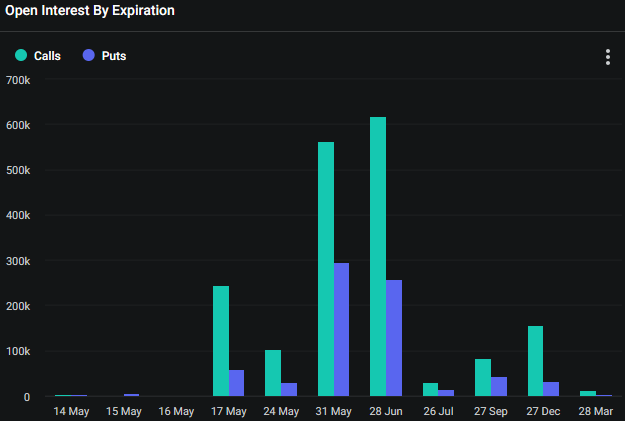

The term structure of open interest in ether options reveals a concentration of calls expiring at the end of June, comprising over 617,000 contracts with a notional value exceeding $1.8 billion, according to Deribit data.

The significant number of call contracts and their substantial notional value could reflect confidence in ether's potential to appreciate by the end-of-June expiry date. The concentration of calls could also support the digital asset's price if derivatives traders choose to exercise their options when the price begins to exceed the specific strike prices outlined in the options distribution.

Ether option open interest is focused on calls with an end-of-June expiry. Image: Deribit.

Call strike price focused at $6,500

Strike prices for end-of-June expiry calls are concentrated above $3,600, with $6,500 being the most favored strike price, according to CoinShares Research Associate Luke Nolan.

The analyst highlighted a significant notional value of $192 million associated with the largest open interest ahead of the June expiry at the $6,500 strike price, reflecting confidence among some traders in ether's ability to reach or exceed this level.

RELATED INDICES

"The largest open interest for end-of-June expiry is concentrated at a strike price of $6,500, with a notional value of $192 million," Nolan told The Block.

Distribution of June-expiry ether options shows that derivatives traders are targeting calls above $3,600. Image: CoinShares.

Put-call ratio suggests bullish sentiment

Data also shows an increasing number of outstanding calls compared to puts in ether options open interest ahead of the end-of-June expiry date.

A put-call options ratio below one indicates that the call volume exceeds the put volume, signifying bullish sentiment in the market. It is assumed that a trader who buys call options is implicitly bullish on the market, while a put buyer is bearish. According to The Block's Data Dashboard, today's ether put-call ratio on Deribit is 0.41.

Ether's price has decreased by over 2% in the past 24 hours and was trading at $2,912 at 5:25 a.m. ET, according The Block’s Price Page.

The GM 30 Index, representing a selection of the top 30 cryptocurrencies, fell 1.61% to 128.16 in the same period.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.